Small Cap Stocks

building investment wealth over time

The Enduring Power of Small Caps

&

The Power of Compounding

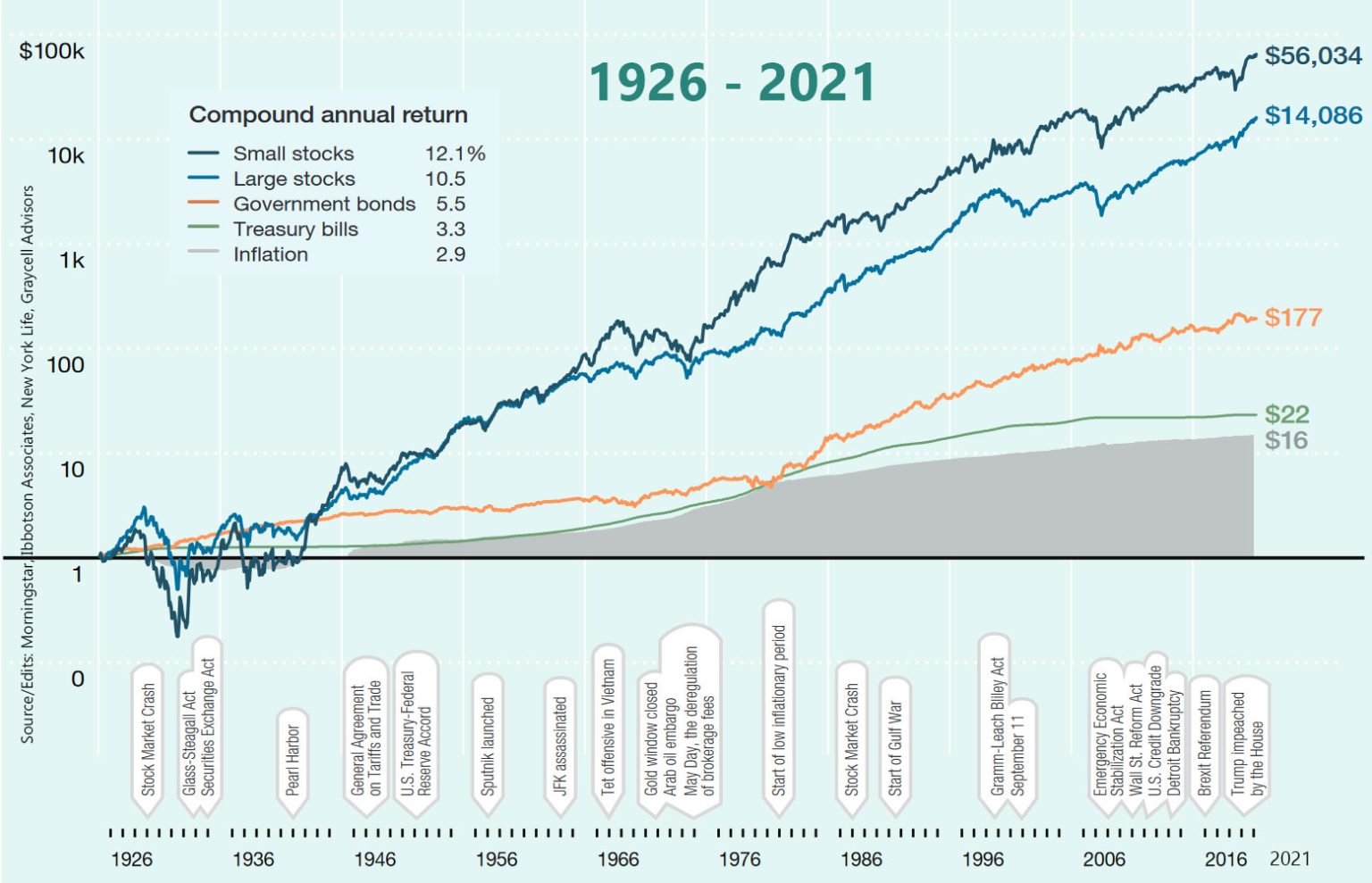

Cumulative Growth of a Single Dollar

Source: Morningstar/Ibbotson Associates, MetLife, edited by GraycellAdvisors.com

The chart above demonstrates the power of compounding when investing in stocks compared to other asset classes. While stocks tend to outperform other investments over the long term, it is important to note that they come with risk, unlike government bills and bonds. The extended time frame in the chart might obscure periods of significant decline, which is a risk investors should be aware of. Nevertheless, the stock market has an incredible wealth generating potential over time.

In these 96 years, smaller-cap stocks have outperformed larger-cap stocks. While the additional 1.6% annual return from small caps over large caps may seem modest, it can accumulate significantly over time, as seen in the final portfolio values of $56K for small caps compared to $14K for large caps. It is important to remember that smaller-cap stocks carry higher risk, which is where the higher-risk, higher-reward potential comes into play.

Focus of the Small Cap Service

The Prudent Small Cap newsletter focuses on a model portfolio of young and emerging companies. Small-cap stocks, which typically represent companies with a market capitalization between $200 million and $4 billion, are known for their higher risk when compared to larger-cap companies. This risk arises from various factors, including the relative youth of these companies, less robust financials, limited access to financing, greater sensitivity to economic conditions, lower stock liquidity, and less coverage from investment research firms.

However, the small-cap and early-stage mid-cap stocks also offer significant opportunities for capital appreciation, primarily due to their undiscovered nature. The goal is to manage and balance this risk-reward profile, recognizing that complete risk elimination isn't possible.

To enhance risk management and improve risk-adjusted returns, we extend our focus beyond traditional small caps to include smaller mid-cap (SMID) companies, which tend to be relatively more stable. Consequently, the Graycell Small Cap Model Portfolio targets companies with market caps ranging from $200 million to $6 billion.

Our model portfolio focuses on generating consistent and robust returns through a disciplined investment approach. This approach combines various dimensions, including process-oriented strategies, market direction analysis, and rules-driven quantitative models that utilize fundamental and technical variables. By blending these elements, we consistently deliver returns that often outperform benchmarks.

We also emphasize the power of compounding. By leveraging the enduring strength of the markets and the magic of compounding, one can build long-term wealth. Our newsletter is a monthly service, complemented by occasional market updates and intramonth adjustments when warranted.

A subscription to the Prudent Small Cap service comes with a risk-free, 60-day money back guarantee.

Graycell Advisors, and its affiliates, officers, employees, families, and all other related parties, collectively referred to as ‘Graycell’ and/or ‘we,’ is a publisher of financial information, such as the Prudent Small Cap, Prudent Biotech, and Prudent Healthcare newsletters. We are not a Registered Investment Advisor (RIA). Historical performance figures provided are hypothetical, unaudited, and based on our proprietary analysis and system performance, back-tested over an extended period. Hypothetical or simulated performance results have limitations, and unlike an actual performance record, simulated results do not represent actual trading and consequently do not involve the financial risk of actual trading. The performance results obtained are intended for illustrative purposes only. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. Past performance is not indicative of future results, which may vary. All stock and related investments have a degree of risk, which can result in a significant or total loss. In addition, the biotech industry and small caps are characterized by much higher risk and volatility than the general stock market. Information contained herein is general and does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. If you decide to invest in any of the stocks of the companies mentioned in the newsletters, samples, alerts, etc., sent to you or available on our websites, you can and may lose some or all of your investment. You alone are responsible for your investment decisions. Use of the information herein is at one's own risk. We are simply sharing the results of our model. Nothing should be construed as a recommendation or an offer to buy or sell any securities, and we are not liable nor do we assume any liability or responsibility for losses incurred as a result of any information provided or not provided or not made available on time, herein or on our website or using any other medium. We cannot guarantee the accuracy and completeness of any information furnished by us. We may or may not have existing positions in the stocks mentioned in our reports. Our models are proprietary and/or can be licensed and can be changed or revised based on our discretion at any time without any notification. Subscribers and investors should always conduct their due diligence with any potential investment and consider obtaining professional advice before making an investment decision.

© Graycell Advisors. All rights reserved. Any act of copying, reproducing, or distributing this newsletter whether wholly or in part, for any purpose without the written permission of Graycell Advisors is strictly prohibited and shall be deemed to be copyright infringement.

© 2003-2024 Graycell Advisors. All Rights Reserved. USA