- Recession fears fueled by an inverting yield curve has investors scrambling for cover

- The US-China trade war has convulsed the market with unexpected bouts of severe volatility

- The trade war is providing a critical assist in pushing the Federal Reserve into an easing cycle instead of a one-off mid-cycle adjustment

- A bullish scenario can be envisioned where the Federal Reserve cuts rates 2 to 3 times, in no small part due to the pressure from this trade conflict, which is then followed by a trade deal or a rollback, creating a highly favorable situation for the stock market

- Trade-related volatility can be stressful but will prove to be transitory and it can be more effective to invest based on the state of the economy rather than trade events

Market Pulse

Problems are being faced by the stock market.

Earnings growth for the S&P 500 companies has dived this year; GDP growth above 2% appears to be a harder endeavor for the second half of the year; business investment is declining; global growth is slowing, and industrial demand is slackening as evidenced by copper prices dipping to new lows.

Then there is the China trade friction, which adds another level of uncertainty. But trade friction at this particular juncture may not be all bad, as there may be a near-term benefit.

If the market can have only one thing at this time, what will it rather be – a Federal Reserve easing or a China trade deal?

The singular most important force in the financial markets is the Federal Reserve. A trade deal with China is of great significance. But it will still have the fraction of an impact when compared to an easing policy by the Federal Reserve which will awash the entire US economy, percolating through to all businesses and consumers. In that context, whatever is necessary to get the Federal Reserve to climb down from its “mid-cycle adjustment” fence and continue its easing, should eventually be good for stocks.

Federal Reserve Needs The Push

Ideally, the US economy doesn’t need a trade war. There is no question that a China trade resolution will be a helpful shot in the arm for the US economy as it diminishes the global business uncertainty resulting from the friction. But as of now, arriving at a trade resolution has been an elusive goal.

But there can be an upside to the prolonged and escalating trade war.

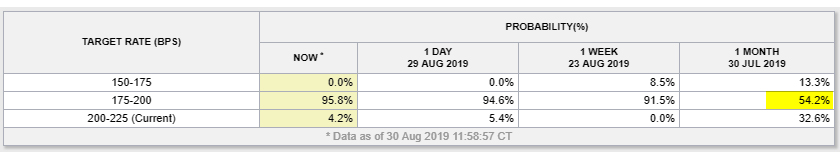

As things stand today, without the trade friction with China the Federal Reserve would not have been pushed into easing in September, the odds of which now range between 95% to 100%.

Looking at it another way, if we already had a trade resolution, will the Federal Reserve cut rates at its mid-September meeting?

Possible, but not likely.

The Federal Reserve is a highly deliberative entity and will need to see more evidence of a metastasizing economic slowdown to justify further cuts to the interest rate. This is not an institution known for being aggressively proactive. Unless economic uncertainty mounts materially beyond the situation in July, when the rate was cut by a quarter-point, the Federal Reserve will likely lean towards greater patience, allowing time for the first cut to make its impact, as well as wait for a more visible deterioration in data. Besides, when one has only 2.25% to work with, a certain amount of frugalness would seep into the decision-making, particularly when consumer spending and employment remain robust. Bolder moves, like a half-point cut, will be even harder to make in an environment that still displays vigor.

An escalation in trade rhetoric and an increase in tariff rates at this point are not all bad if it induces the Federal Reserve to cut rates and offer a bulwark against the rising winds of trade conflict sweeping across the globe.

The incremental downside of tariffs rising from 10% to 15% or from 25% to 30% is not significantly more than the initial damage that has already occurred. Once a hurricane has already blown through, a follow-up rainstorm is a mere inconvenience.

But there is a benefit to this rising trade-related saber-rattling as it’s a clear-cut and visible negative data point for the Federal’s Reserve’s calculus which will tip the policy in favor of an interest rate cut. Even stragglers on the Federal Reserve’s Open Market Committee, which sets the interest rate, should be persuaded by the trade conflict datapoint. Note that in terms of expecting a September rate cut, the market was only a little over 50% a month ago.

The tariff issue is bringing the Federal Reserve to the stock market’s side by easing once again in September.

Ongoing Trade Issues Can Get The Market Into A Good Place

Using the proverbial making of lemonade from a lemon-like situation, the trade friction is helpful if it nudges the Federal Reserve to adopt a more accommodative policy.

If the tariff situation stabilizes at the present level without a resolution, the market can attempt to consolidate and rise higher on the back of an ongoing monetary easing cycle.

If the tariff situation gets worse, it will enhance volatility but also continue to exert growing pressure on the Federal Reserve to continue easing. This may be a contrary opinion considering Chair Powell’s comments last week,

While monetary policy is a powerful tool that works to support consumer spending, business investment, and public confidence, it cannot provide a settled rulebook for international trade. We can, however, try to look through what may be passing events, focus on how trade developments are affecting the outlook, and adjust policy to promote our objectives.”

However, if such friction begins to affect US economic growth materially, adversely impacting business investments, consumer spending, and confidence, it will be hard for the Federal Reserve to look through or look away. It will be forced to act in line with its desire to do what it can to extend and sustain the economic expansion.

In both the above situations, it can be a more fruitful exercise for investors to sit on their hands and control the urges that get many investors into trouble, as Warren Buffett would say. If your risk management requires you to reduce portfolio exposure or be out of the market, then do so. After all, we are discounting the possibility of a recession. But you do not have to react to each bout of trade-related volatility.

But, what if the tariff situation improves. Even though the likelihood can be considered slim at this point for immediate relief, it is a possibility that is just as real as rising tariffs.

Here is a bullish scenario for the market’s next leg up.

The tariff war continues to provide that adverse datapoint which along with the slower evolving data around economic deterioration keeps building up pressure on the Federal Reserve to continue with an easing cycle, instead of a mere mid-cycle adjustment, giving the market one to two more interest rate cuts by the end of the year. Then the trade resolution comes through. It will then have the impact of a stimulus package for the stock market. Also, a trade resolution in any form will be better than the current state for US companies operating in China, which will further add to the business optimism.

Even though things look grim right now, the trade process has evolved in quite a random and unexpected manner. So a favorable possibility of some resolution or a walk-back can also be just that unexpected outcome which the market doesn’t appear to anticipate presently. There is a US-China trade meeting in September and who knows we may have some rollback of previous policies as a confidence-building measure. That will provide a boost to investor sentiment.

Circuit-breakers On Tariff Related Market Fallout

If one is to observe what has transpired throughout the trade friction since April 2018, when direct tariffs were imposed, most major frictional moves by the White House were followed by a reconciliatory or complimentary message, which arrested a more serious market decline.

There is a desire to resolve, as such comments and tweets leave the door open to continue negotiating towards an agreement. The White House to some extent controls the outcome, since only it knows for sure what kind of an agreement will be considered a victory. At least we hope so.

Yield Meltdown Can’t Continue Forever, As Time Value Of Money Can’t Vanish

The yield meltdown can’t continue forever in an economy that is still growing at ~2%. The foundational principle of the time value of money cannot be swept away when we are not plunging towards a recession or depression.

The sharp decline in the term structure of rates has left investors in shock and awe, as the 30-year bond has slipped below 2% yield. This steep slide in long-term yields may not be entirely due to the fear of a recession. The world is facing a mountain of negative-yielding debt, $17 trillion as of mid-August or ~30% of total debt, as large economies are slipping towards a recession.

Capital has to find a return. The tsunami of money flowing into the US treasury market is also being driven by the compelling need for both the safe-haven status and a positive yield. This has contributed towards building distortions in the US yield curve, which may be reflecting broader negative yield issues as well and less of an urgent canary call for an imminent recession. This has to normalize at some point, as the economy is not at a precipice, and when it does it will put some support under stocks as recession fears abate. Incidentally, if the Treasury appears to be in favor of issuing ultra-long maturity bonds, like 50-to-100 years, that will begin to push the 30-year yield higher.

Conclusion

The market is under pressure from mounting concerns about an economic slowdown and a looming recession. The yield curve inversion has made investors edgy due to its historical reliability as a signaling mechanism in predicting past recessions, although highly respected Federal Reserve officials believe the signal to be distorted at this point. No wonder volatility has spiked and major indexes like the Nasdaq (QQQ), S&P 500 (SPY), Dow Jones (DIA), NYSE Composite (NYA), and the Russell 2000 (IWM), have been just trading between a range of resistance and support. Sector ETFs like healthcare (XLV), biotechs (IBB), finance (XLF) and energy (XLE), have been hurt even more.

The trade dispute with China has further raised economic uncertainty and market volatility. However, we believe such trade-related market volatility is best ignored for now. The trade friction is serving the cause of a monetary policy easing, nudging the Federal Reserve towards action once again on September 18, and continuing to boost the case for further rate cuts. Furthermore, if the trade resolution is to come after 2 to 3 rate cuts, it will place the stock market in an even better position to move higher, benefitting from both lower rates and lower trade uncertainty.

The shrinking of the long-term yields has made stocks attractive. No other major developed economy is demonstrating the relative strength of the US economy, despite the issues. Money has to find a return when there is economic growth.

The Federal Reserve easing cycle, if it persists, will continue to support stocks. In our Prudent Biotech and the Graycell Small Cap model portfolios, we have refrained from weekly adjustments to the frequent bouts of trade-related volatility. Neither such volatility can be predicted nor can it be successfully invested. We will calibrate our market exposure based on our risk management, but not because of solely trade friction.

A few of the biotech and smallcap stocks that are attractive in our quantitative system, and maybe part of our model portfolios now or in the past, include Amgen (AMGN), Arrowhead Pharmaceuticals (ARWR), Alnylam Pharmaceuticals (ALNY), Coherus Biosciences (CHRS), Karyopharm Therapeutics (KPTI), Medicines Company (MDCO), Achillion Pharmaceuticals (ACHN), Arqule (ARQL), Provention Bio (PRVB), Tandem Therapeutics (TNDM), PROS Holdings (PRO), Telaria (TLRA), Natera (NTRA), Cardlytics (CDLX), Lattice Semiconductor (LSCC), Invitae (NVTA), Infinera (INFN), and Enphase Energy (ENPH).

For context, the article was submitted at 11:00 am ET on Aug 28, 2019 to Seeking Alpha.