Market Pulse

The stock market remains unsettled and vulnerable to sharp declines. Over the last two weeks, the market has forcefully stepped higher from its oversold levels as the federal response in the form of a $2 trillion stimulus was finalized and hotspot areas are achieving a deceleration in new cases. This has ensured that the market has not made new lows yet from the last time we printed the table below.

The highly unsettled nature of the market should not be unexpected. It is after all a bear market and sharp rallies are just as much a part of it as sharp declines. No bear market has ended in 1-month, and no bear market has made a low in its first month.

Tendrils of the Pandemic

Reaching Deeper into the Economy

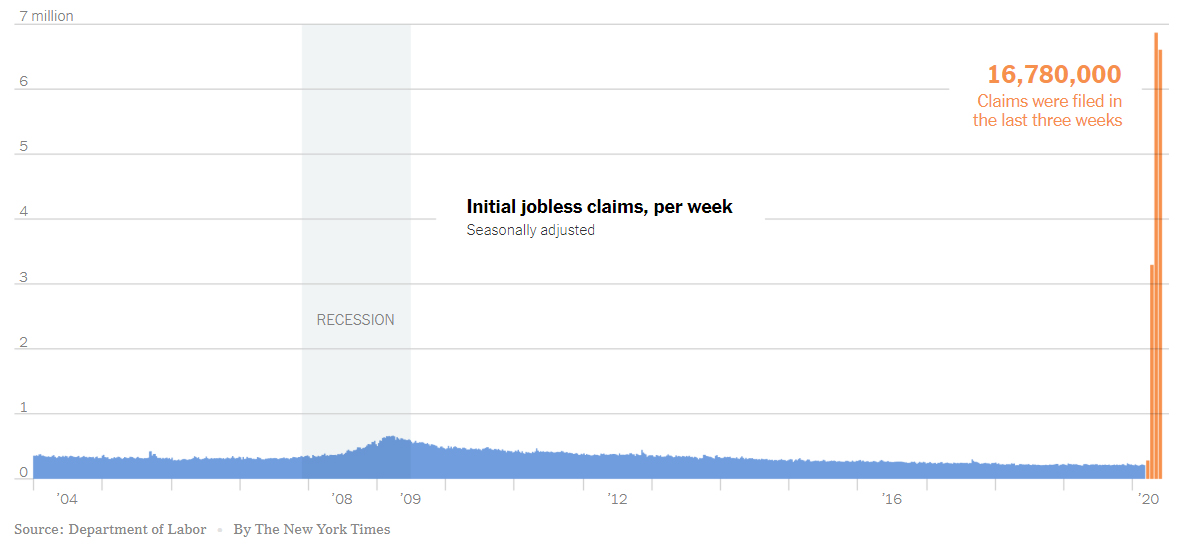

The recent unemployment claims and the nonfarm-payrolls were jarring news. But they were expected. And they still remain understated. In the last article, Reviving a Comatose Economy, we had noted that over 80 million people in the US workforce are hourly wage workers. One would suspect, at least one-third and perhaps even as high as 50% would get affected as shut-down sweeps across most industries. That would mean the cumulative total of unemployment claims filed over a 6-week period from Mar 21 till the end of April could approach nearly 20 to 25 million, representing a quarter to one-third of the hourly workforce.

The claims would be even higher if not for the incentive to employers to maintain payroll at close to zero cost. The success of the Paycheck Protection Program (PPP), part of the $2 trillion safety net, in reaching businesses can be gauged by the pace at which unemployment claims expand. At this time, the running total over three weeks, since Mar 21, is ~17 million claims. To gauge the severity of the economic blow we are facing, during the entire Great Recession there were less than 9 million jobs lost and the highest weekly claim was 0.67 million.

Unemployment claims are a volatile number and mostly used as a secondary indicator. But this time around the predictive value of unemployment claims is significantly enhanced for it's a quicker weekly number that is directly related to the pandemic and is reflective of the success of the PPP program. The higher the unemployment claims go, the stronger the suggestion of a deeper economic fear amongst small businesses who are rejecting the offer of full payroll reimbursement for the next 8-weeks. We would suspect that anything above 25 million claims (or ~30% of the hourly workforce) would start to become a cause of concern on the ability to rapidly bounce back, and if the claims reach 40 million (~50% of the hourly workforce) it can be indicative of a potentially severe economic contraction. But we should be mindful that bringing back hourly workers is a lot quicker when conditions improve compared to salaried workers.

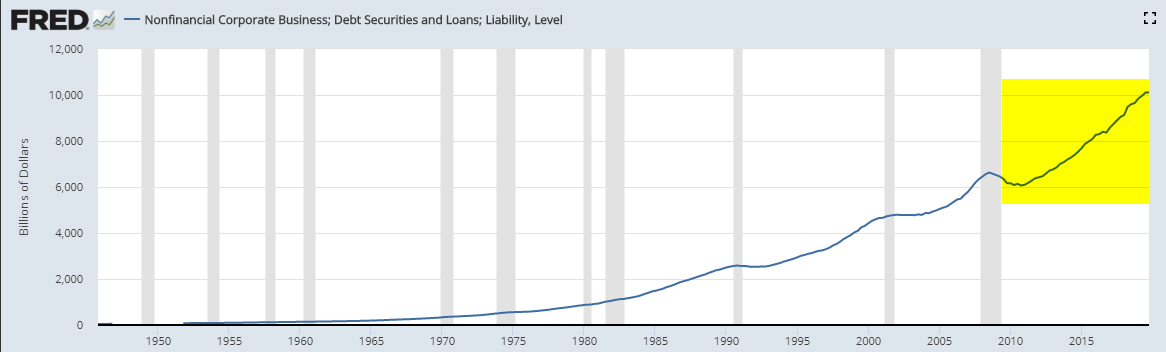

Credit is the grease that lubricates the wheels of the economy. And as occurs in most crises, when the economy grinds to a halt, credit becomes harder to obtain. In many industries, economic activity has sharply dropped both in the US and around the globe. With over $10 trillion of non-financial US corporate debt outstanding, a steep and rapid falloff in revenues is bound to jeopardize the ability to service a growing portion of corporate debt for the most adversely affected industries. The collapse in oil prices, even if an agreement is reached to reduce output between Saudi Arabia and Russia, puts a meaningful slice of drillers and production companies under survival stress as oil demand has plunged precipitously due to the viral pandemic.

In absolute dollars, corporate debt, fueled by low-interest rates, has risen at its fastest pace after the Great Recession as can be seen by the steepness of the curve in the exhibit below.

The rolling debt wheel works on the premise that there is more debt that can be issued in the future to pay off the debt that comes due. It's just the same way the US government operates. However, corporations don't have the money printing presses of the government when a crisis strikes. With each passing month that trade and commerce remain muted, the risk of the corporate debt mushrooming into a bankruptcy crisis grows rapidly. Then there is the state and local debt in the US that further squeezes the clamps on the credit markets.

Returning to A Different Normal, Not The Old One

The viral outbreak is a public health crisis. Till it is resolved, businesses and people cannot return to the old normal. The situation can be resolved to the old normal level only when there is a vaccine, which at the earliest is expected in the 2nd quarter of 2021 based on current expectations. A therapeutic drug will greatly help to limit the downside, but will still not induce normal behavior. So it is quite likely that a return to the old normal, or as close to it as possible, will be reached in the second half of 2021 as the vaccine becomes broadly available.

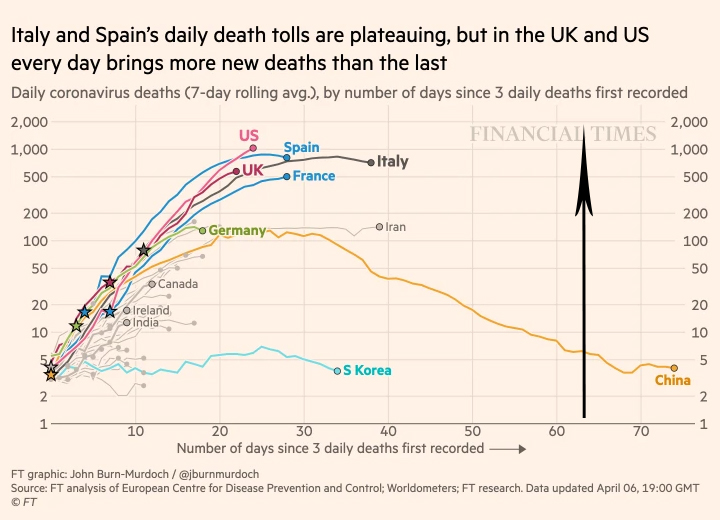

Looking at the highest point of the virus-related daily death rate or the total deaths can provide a quick insight into how well or poorly the pandemic onslaught has been managed so far, and the impact it will have on recovery. The higher the number of daily lives lost, the more severe and deeper the impact, and so the longer it will take to recover both psychologically and economically.

It is clear from the graphic above that the US has the worst rate of daily deaths. Part of that is a function of the US being a more populated country. But a great deal of it has to do with a delayed start in addressing the pandemic with the full force of the government. Major European countries have been remiss as well in their pandemic management, leading to costly adverse outcomes, while South Korea has been the best in suppressing its daily death rate thus far.

The experience of other countries who are ahead in the outbreak timeline is helpful to the extent that they had a similar pandemic management effort. China which has progressed the furthest can provide a template in recovery efforts. But the country had a much more rigorous implementation of pandemic management protocols after becoming ground zero. The US and Europe will probably witness a similar recovery trajectory but one that is stretched longer or somewhat delayed. A caveat is that Chinese data has been alleged to be understated.

It took China about 2 to 3 months to begin showing signs of recovery after the Dec 2019 outbreak. Based on an intensifying outbreak in the US in late-February, the signs of recovery should begin to appear in late-May and June.

The most common-sense approach to return to a new normal would be to open sections of the country based on certain public health milestones. The milestones will be uniform across the country and set by the Federal government as minimum conditions to be met prior to removing shut-down. The milestones can require that access to testing is easily available using a metric of tests per 1000 people, the state/county health service should have the ability to do contact tracing, community spread is below a pre-defined metric, and that the healthcare system in the state is capable of attending to the needs of new patients using a capacity metric. States and counties can then overlay their own common-sense, scientifically-driven requirements. For e.g., not congregating in groups of more than 50 or whatever seems appropriate, etc. As sections of the country are opened gradually, the new normal would include existing precautions and a willingness to shut-down in case of a viral resurgence.

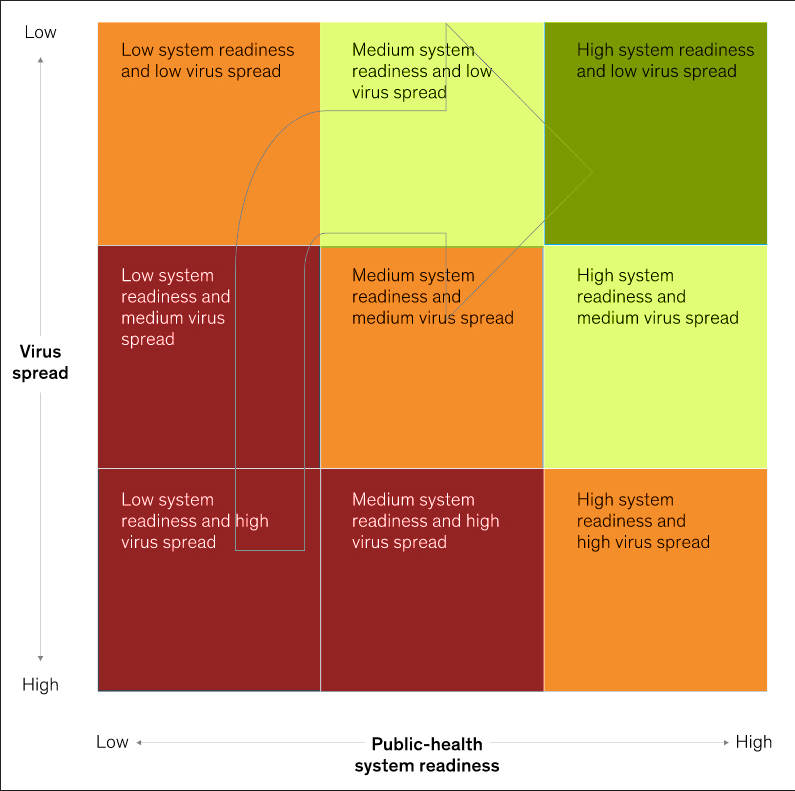

The exhibit below has been offered by the management consulting firm McKinsey as a way of understanding the placement of states in the COVID-19 outbreak and a path to reopening. The placement of arrows in the box and color edits are by PrudentBiotech to show the Red, Orange and Green levels of alert. The original graphic can be found here.

What Kind Of Recovery To Expect

What kind of recovery can we expect as we transition from saving lives to saving livelihoods?

While the focus in April will remain on saving lives and suppressing the virus by reducing the rate of community spread, at some point a strategy needs to be outlined to gradually transition towards restoring social and economic interactions in late-May.

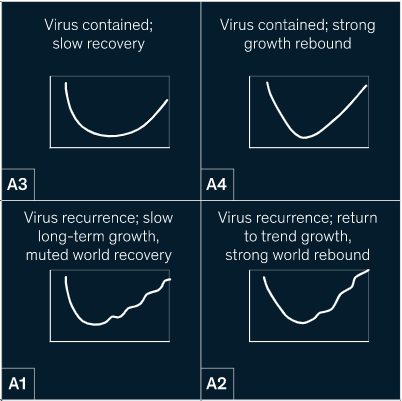

The economy has been deeply affected and may have even suffered long-term damage to sectors like travel and leisure. There has been a viewpoint gaining currency which predicts a strong V-shaped recovery. Although it would be quite delightful to have one, such a recovery will have to assume a complete return to normal that existed in the pre-virus days. That is a remote possibility at this point as the virus cannot be contained until a vaccine is available. Thus, human behavior, productive capacity, and consumption will remain guarded until the vaccine arrives.

In addition, the world economy has been damaged in a synchronized global recession or contraction. This is a unique economic situation, where both significant supply disruption and demand contraction has occurred on a global scale. A V-shaped US recovery would require that key economic blocs around the world also emerge out of their recession or slow growth in their version of a V-shaped recovery. That is hard to predict and perhaps too much to expect.

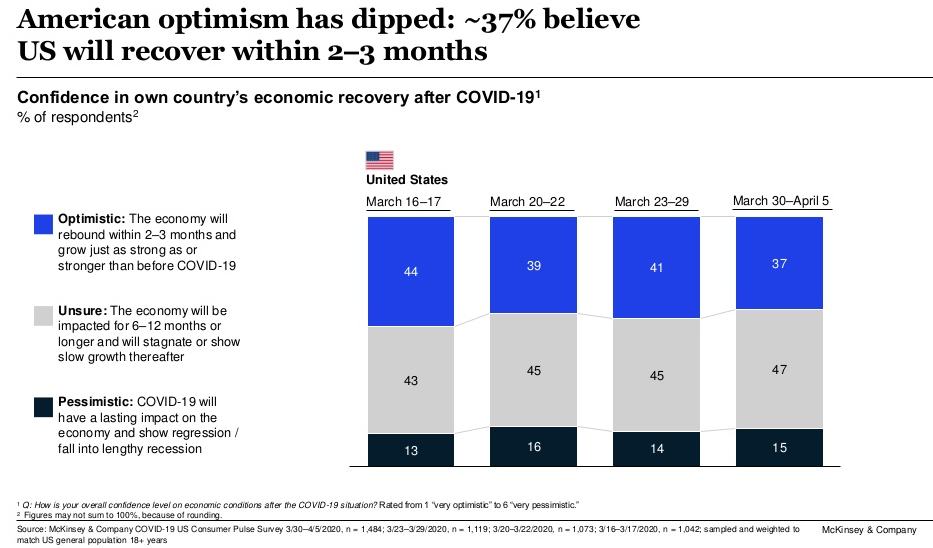

In a recent corporate survey by McKinsey, there were four possibilities that were envisioned by many business leaders.

We suspect the whole process towards recovery will be highly nuanced, a learning curve in itself adjusting to the setbacks. It appears unlikely that an economic recovery can be rushed till basic elements are in place, not rhetorically but realistically. The testing infrastructure remains overwhelmed and backlogged, even as it scales rapidly higher. The plan for recovery must not raise the risk of another downturn.

In our opinion, A3 and A4 scenarios will be greatly desired but have a lower probability at this time. We would suspect it would be either the A1 or A2 scenario.

A key propellant for US economic recovery will be the layering of timely mega-stimulus packages. The Federal government has approved over $3 trillion of support packages with more on the way. Besides, the monetary stimulus from the Federal Reserve has been significant with zero rates and an open balance sheet to assume new loans. This improves the likelihood of a robust recovery, in the shadows of COVID-19, with a sharp short-term rebound accompanied by a leveling-off followed by another step higher.

We believe the US economy will step into positive year-over-year GDP growth in the first quarter of 2021, while positive sequential or quarter-over-quarter GDP growth should occur in the third quarter of 2020.

Stock Market Outlook

It was Yogi Berra, and a few others, who are often credited with the words, "It's tough to make predictions, especially about the future."

Yogi understood the perils of prediction. That is why it is key to remain flexible as data evolves, and not be wedded to an opinion.

We are in a bear market. Bull markets don't emerge immediately after the first leg-down, at least not typically. But bear market rallies do emerge.

We have mentioned in our previous writings that stock market returns are driven by its three underpinnings - the economy, earnings, and monetary policy. At any time, at least two have to be favorable for positive returns. It would be reasonable to say that only monetary policy is supportive presently while the economy and earnings are not. Earnings estimates for 2020 are meaningless and not even the present fourth-quarter estimates will be met for the S&P 500. When the market reconciles to a lost year of growth in 2020 and starts looking at the 2021 estimates, I believe that will give rise to a bull market.

If the bull market case rests on a V-shaped recovery, then it's resting on a lower-probability event. In our opinion, the bull market will emerge towards the end of the second quarter or early third quarter. We would suspect the market can bottom-out in May. A deeper decline beyond recent lows should most likely be arrested by the cushioning provided by layers of billion and trillion-dollar stimulus packages, and an aggressive Federal Reserve.

If at any moment of time you have to stick to a plan, it is when you enter a bear market. Whatever template you work from and whatever experience has taught you, now is the time to use them. A bear market presents some of the most alluring rallies, and at the same time can harshly erode a portfolio. It's not easy to know when to step back into the market or be out of the market. The fear of missing out on a bear market bottom is in itself a very compelling emotional trigger, particularly during steep rallies. But one has to be careful early on in the bear market, for it can often end up creating unprofitable situations as the bear gets back to doing its work.

One thing is clear, the vaccine will be the only cure for the economy to recover to pre-virus levels. But we don't have to wait that long to resume productive economic activity. Society can adjust and adapt, once the threat becomes manageable, to behave in a manner that diminishes the risk amongst people. Some of the practices that will be adopted in the US have already been mainstream in many parts of Asia, which have witnessed viral outbreaks like SARS.

The day that Americans begin to feel that if they fall sick they will have ready access to hospital care with a very high probability of surviving the virus, will be the day America will begin its journey back to work. To nudge the population forward, as a prerequisite the Federal government will have to begin underwriting all treatment costs of COVID-19 that healthcare insurance does not cover, and testing infrastructure is allowed the time to scale higher and is stabilized.

In our estimate, the point when America begins to responsibly and gradually resume work can occur in the second half of May, led by the data.

The key thing as an investor is to remain flexible for better or worst outcomes. You do not have to pick the bottom of the bear market to succeed. The approach that we have is to reduce portfolio exposure during a bear market, but not be completely out. Part of the portfolio can benefit from sharp rallies, while the uninvested portion can be deployed over time as market conditions confirm a turnaround. But whatever the plan you've set for yourself to manage risk, work within that plan. The model portfolios of Prudent Healthcare, the Prudent Biotech, and the Prudent Smallcap are presently 30% to 50% invested.

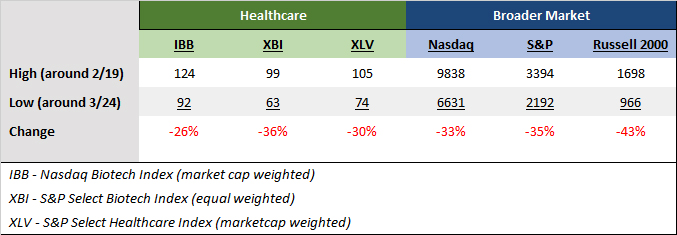

The S&P Healthcare Index (XLV) has done relatively much better than the broader market. Biotechs, particularly larger caps, have done even better as represented by the Nasdaq Biotech Index (IBB). There are many healthcare and biotech stocks, some of which may already be part of the model portfolios, that remain attractive. A few of them include Vertex Pharmaceuticals (VRTX), Gilead Sciences (GILD), Vir Biotechnology (VIR), Moderna (MRNA), Regeneron Pharmaceuticals (REGN), Momenta Pharmaceuticals (MNTA), Acceleron Pharma (XLRN), Collegium (COLL), ChemoCentryx (CCXI), DexCom (DXCM), Luminex (LMNX), Masimo (MASI), Karuna Therapeutics (KRTX), Zai Lab (ZLAB), Kodiak Sciences (KOD), NeoGenomics (NEO), Seattle Genetics (SGEN), Eli Lilly (LLY), and Biogen (BIIB).

The article was submitted on April 8 to Seeking Alpha.