Small Cap Pulse

Small cap stocks faced a challenging environment for most of last year amid concerns of an impending economic slowdown and the weight of higher rates. Despite these challenges, economic growth outperformed expectations, and a late reversal in the 10-year yield prompted a surge in small cap stocks (IWM) along with the broader market.

Last year in the 2023 Small Cap Outlook, it was noted that:

"We believe the small caps can deliver returns of 15% to 20%. This assumes the current market expectation of a ...March peak in interest rates, and a rate cut in December 2023."

The Russell 2000 Index gained 15% last year in anticipation of rate cuts in early 2024.

Path of Small Caps in 2024

The Fed Funds rate will likely finally head lower this year. The direction of small cap stocks in 2024 hinges on the Federal Reserve's actions, specifically the timing and pace of rate cuts.

The first half is seen as vulnerable, potentially marked by a slower rate-cutting pace, the Fed's potential attempts to walk back market expectations, and a risk of further earnings deceleration. The second half, however, is anticipated to be more robust as rate cuts gain momentum, supporting the economy.

Fed Actions Will Guide Small Cap Performance

Since the Fed's actions will determine the prospects for small cap stocks this year, it will be helpful to know where the market expectations are for rate cuts.

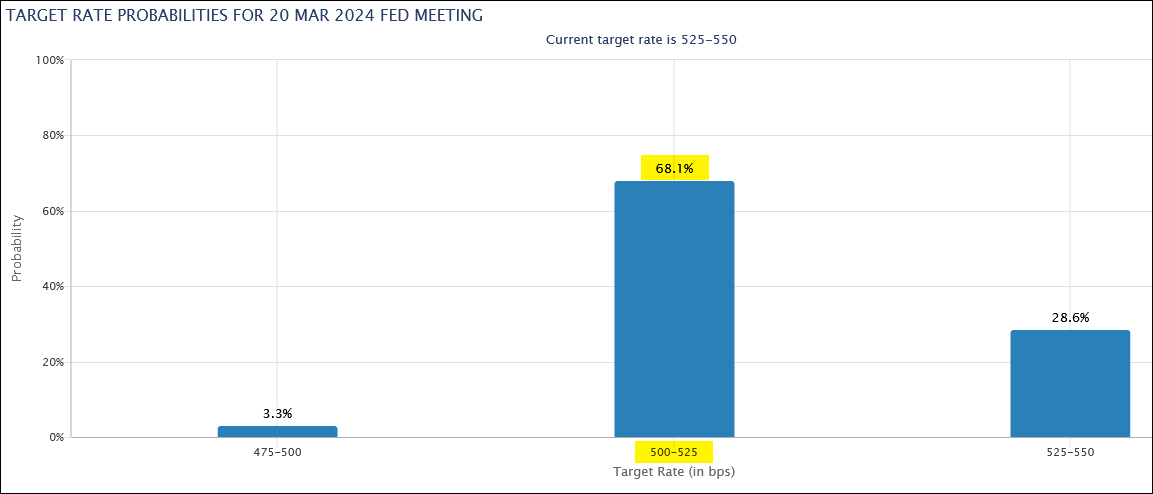

Presently, the market anticipates a first Fed Funds rate cut in March 2024, with a projected total of six quarter-point cuts for the year. This contrasts with the Fed's recent projection of three cuts, which is subject to updates based on evolving conditions.

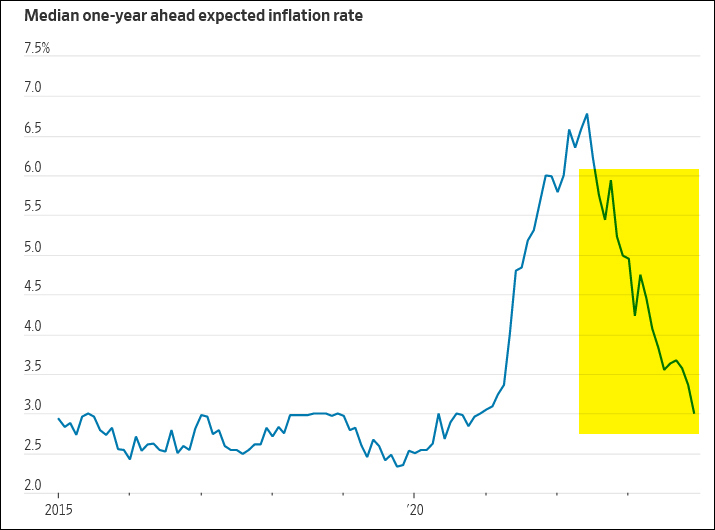

Factors supporting a rate cut include the alignment of interest rate policy with real interest rates, given the decline in core inflation. The Fed Chairman has acknowledged that interest rate policy should track real interest rates. With the core inflation rate at an annual 4% rate, down from 4.7% in July 2023 at the time of the last hike, real rates are now much higher. If core inflation progress continues, it is supportive of a Fed move sooner rather than later.

Another factor that should be reassuring to the Federal Reserve is that inflation expectations are now declining sharply. The central bank regards consumer inflation expectations as being an important indicator to gauge inflation, since higher inflationary expectations can cause an entrenchment of inflation and have ripple effects as it spurs wage inflation.

What happens in March?

The impending March decision holds high stakes and can be a critical turning point for the market. We believe there is a risk that the Federal Reserve will be more cautious about rate cuts in the first quarter itself. A resilient economy thus far with low unemployment can also diminish the urgency for the Fed to cut rates in the first quarter.

The first rate cut will prove to be the hardest one to make for the Fed as it will signal the end of the inflation fight. The Fed would like to get it right so as not to backtrack, which will adversely affect market confidence. Thus, we believe we can witness a more cautious and deliberate Fed with the likelihood that the first rate cut does not occur in March.

If the Fed does cut rates in March, the prospects for small caps will see a short-term boost.

Economic Uncertainty

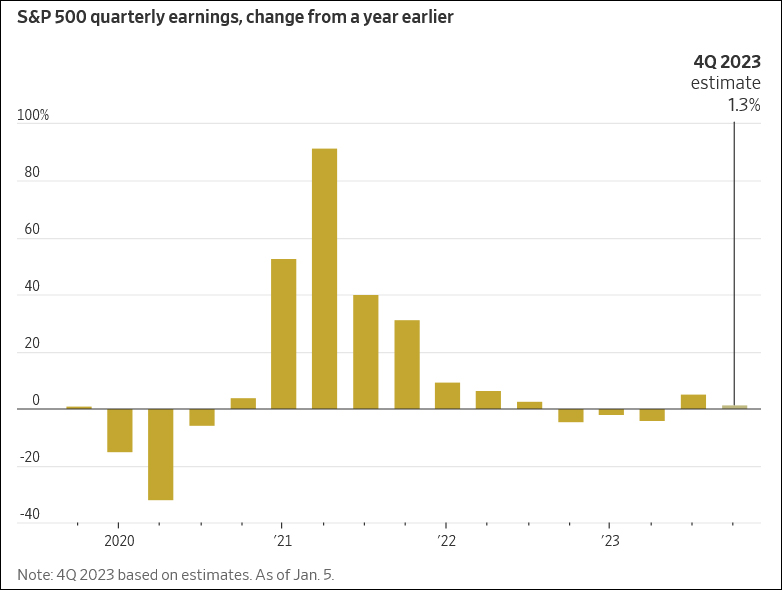

Small cap stocks thrive in a growing economy, but uncertainty and fear of a looming recession pose challenges. The economy remained resilient in 2023, supported by strong consumer spending which was undeterred by rising interest rates. However, the interest rate burden persists, as evidenced by negative guidance from S&P 500 companies, including the warning in December from FedEx about weakening demand.

The fourth quarter earnings growth for S&P 500 (SPY) companies is expected to be a meager 1.3% and the full year growth rate will be less than 1%.

Market gains in 2024 will have to rely more on earnings expansion than a multiple expansion.

During 2024, companies will be losing pricing power, as supply chains heal, pent-up demand fades away, and consumer inflation expectations drop. Lower pricing power would suggest more restrained revenue growth, and consequently lower earnings growth. It would also mean that any margin expansion, the other key driver of earnings growth, will have to come from slower hiring, cost-cutting, and seeking efficiencies. Current projections are for annual earnings growth to rebound in 2024 to over 12%.

Thus, the stock market, at least for the first half, is likely to encounter an environment of low GDP growth of around 1%, a lower inflation rate, and low earnings growth. We believe earnings will begin to rebound later in the second half due to the momentum from rate cuts.

The earnings season unfolds this week and the narrative and guidance from companies will play a crucial role in determining the continuation of the rally. The insights will be helpful in understanding if we are going through a deeper earnings slowdown or will soon witness an earnings rebound.

The primary reason for the market rally has been the growing confidence that the Fed can orchestrate a soft landing, a term to indicate slow growth and no recession. With inflation easing rapidly, the market has high confidence that the Fed will be able to now pivot toward rate cuts to support the economy. Any disappointments will cause significant volatility.

Conclusion

Small caps are highly sensitive to the economy and that is why any discussion of small caps in the present environment starts and ends with economic growth and the Fed policy.

Navigating small-cap investments in 2024 requires careful consideration. The first half poses risks, contingent on the Fed's March decision and potential economic shifts. A rate cut will be in line with market expectations and boost stocks. However, if economic conditions are deteriorating rapidly at that time, then gains from a March rate cut will be short-lived. If the Fed decides to not cut the Fed Funds rate in March, then it will trigger downside volatility for small cap stocks. The second half is expected to be stronger with more favorable conditions.

Our outlook suggests small caps could deliver returns of 15% or higher in 2024, contingent on no recession, no further rate hikes, and at least five Fed rate cuts of quarter-points to a range of 4% to 4.25% from the present 5.25% to 5.50%.

Small cap stocks present attractive opportunities, particularly as expectations are for the economy to execute a soft landing and turn around as the Fed cuts rates, along with earnings growth to strengthen later this year.

In a likely difficult first half, small cap companies with robust and resilient earnings growth should be preferred and investors should rotate during the year into stronger and defensive industry groups. Unprofitable firms with low revenue growth, including technology companies, will be less attractive. Small cap companies in defensive sectors like healthcare (XLV) can outperform. While smaller biotechs (XBI) carry risk, those with adequate capital are better positioned as they are less burdened with earnings growth concerns. More can be read about biotechs and healthcare in the recently published outlooks, Biotech Bonanza and the Healthcare Outlook 2024.

The next Fed meeting outcome on January 31 will provide further insights into the Fed's thinking and will set the market tone. It is the only meeting before the crucial one on March 19-20.

There are many strong small cap companies and the opportunities are going to become numerous as the year matures. A few promising small cap companies presently, that may already be part of the Prudent Small Cap or Prudent Biotech or Prudent Healthcare model portfolios, include TransMedics (TMDX), Modine Manufacturing (MOD), The Greenbrier Companies (GBX), Procept BioRobotics (PRCT), G-III Apparel (GIII), CECO Environmental (CECO), Aspen Aerogels (ASPN), Ideaya Biosciences (IDYA), Nuvalent (NUVL), Twist Bioscience (TWST), Alphatec Holdings (ATEC), Symbotic (SYM), and RxSight (RXST).

This outlook is a general framework to guide investors and is subject to adjustments if market conditions deviate materially from current expectations.

This article was first published on Seeking Alpha.