Market Pulse

The year 2020 was a starkly contrasting tapestry. As the economy was reeling from an unrelenting pandemic, the stock market overcame a severe drop to march higher during the second half. It's a year that will not be missed for the challenges it presented. But for many investors who were appropriately positioned, it did provide some fond memories.

Last year presented challenges that were unprecedented in modern history. So predicting the market was a game of luck! You could be right one month and be completely wrong the next.

It was a year that required both change and continuity to stay ahead in the market. A year in which it was hard to predict where things would go, but changing quickly to recognize and accepting a new overarching trend was an essential predictor of success. Continuity in the market was needed by staying invested in the second half. With the new bull market becoming super-expensive from Summer onwards as the economy withered, it required continuity of the investment approach and being overweight equities to capture attractive returns. Staying on the sidelines would have been a frustrating experience.

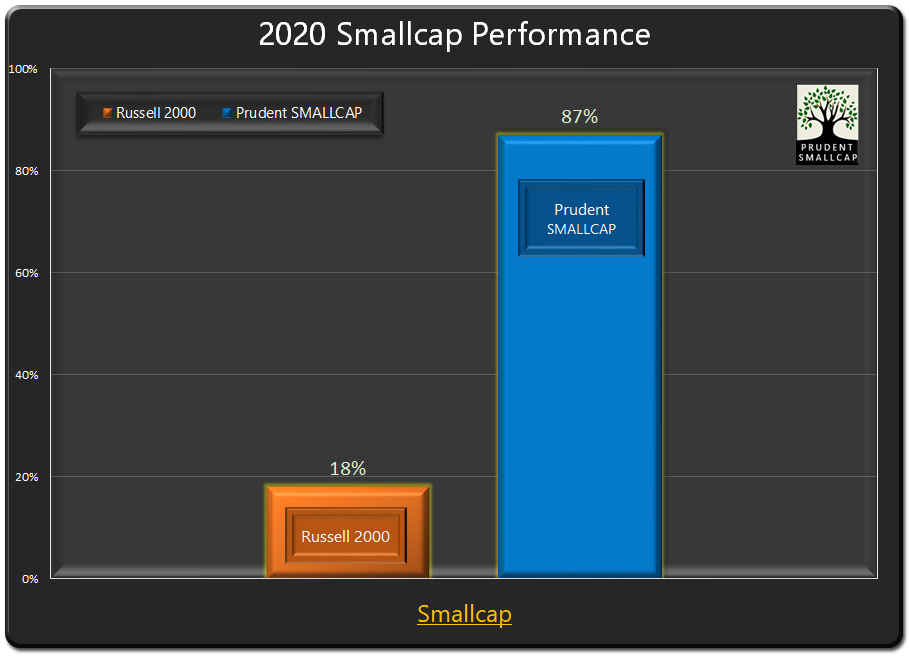

In determining total returns, equally important as security selection are the times when one is invested and the investing behavior based on the investment approach. The approach served us well as the Prudent Small Cap model portfolio outperformed the Russell 2000 index (IWM).

Small Caps To Be Stronger in 2021

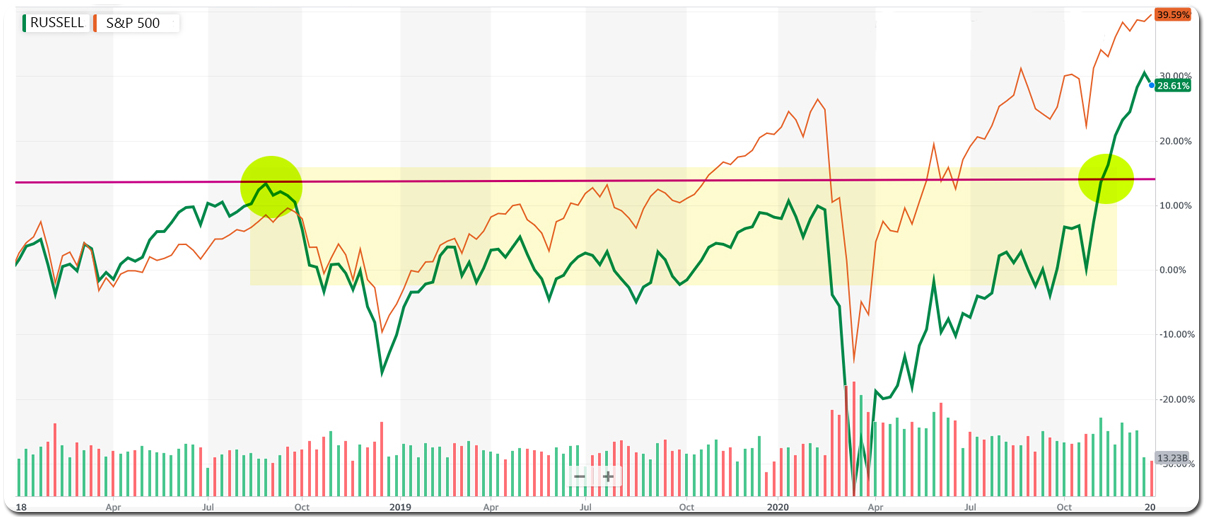

The Russell 2000 small cap index has underperformed the larger caps materially over the last two years. It may come as a surprise, but small cap stocks made their all-time high in September 2018. For over two years, the small cap index just consolidated, while large cap stocks, represented by the S&P 500 (SPY) and the Nasdaq (QQQ), notched multiple new highs in 2019 and 2020. It was such rough going for small cap stocks that entering November last year, they still had negative returns for 2020. The powerful rally that emerged since then has allowed the small cap index to finally breakout to a new high. But it still has a lot of catching up to do.

Indexes that break-out after a lengthy, long-term consolidation, typically maintain an uptrend. This is recently true for the biotech group as well, where the Nasdaq Biotechnology Index broke late last year from a 5-year long consolidation, as discussed in our Biotech Bonanza 2021 Outlook.

Monetary Policy, Fiscal Policy, and Economic Growth Align for Small Caps

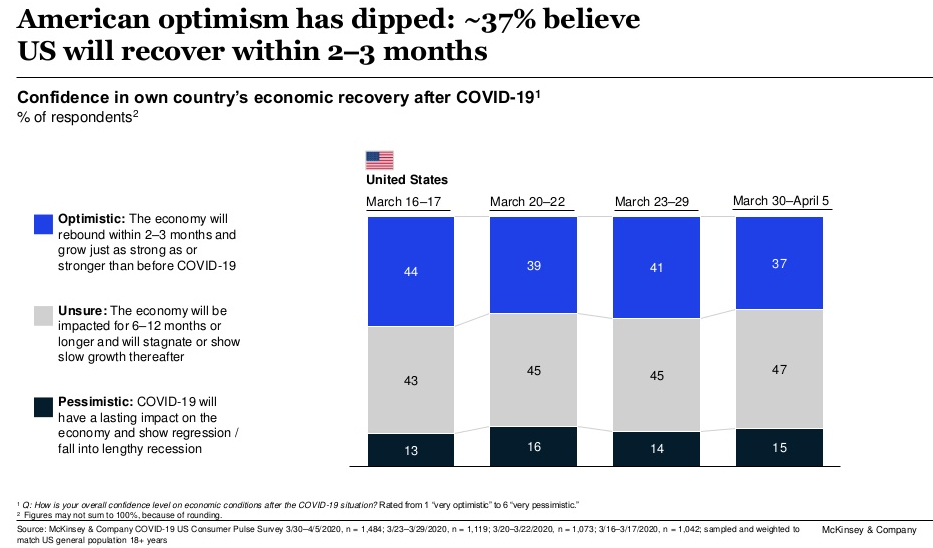

Small cap stocks are quite sensitive to economic optimism. The best period for this segment is during the growth phase of the economy and particularly the early years of a new economic cycle.

Monetary policy has been supportive of the stock market for over a year now. However, now it is clear that we are in a very low-interest-rate environment for an extended period of time. With the economy requiring significant monetary stimulus to recover from the ravaging impact of the pandemic, there are no interest rate hikes possible during 2021 and even much of 2022. This climate is supportive of economic growth, and also promotes investment risk-taking due to the low cost of money and limited alternatives for higher returns.

At the same time, fiscal policy is going to be highly supportive of rebuilding the economy and restoring it to pre-pandemic levels, perhaps by early 2022. The trillions of dollars in fiscal stimulus have truly prevented the economy from unraveling into a sinkhole. And more will be needed to restore the economic fabric. Never let a good crisis go to waste are the insightful words of Winston Churchill, and a time-tested management mantra. It will be true here for the Federal government as well as it embarks on some mega projects, including an infrastructure plan. Such targeted fiscal spending will be favorable to economic growth.

Small Caps Can Be The High-Growth Cyclicals

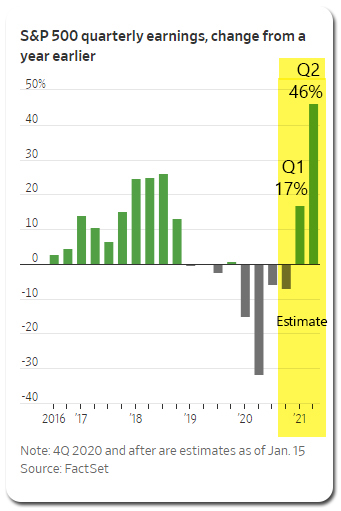

Economic growth is going to rebound sharply in 2021, as the clouds of the pandemic begin to clear in the second quarter. When monetary and fiscal policies operate in tandem, the wind blows strong into the sails of the economy. Investors should be positioned accordingly.

With an anticipated surge in US economic growth, economically sensitive companies will be amongst the prime beneficiaries. The rotation into cyclicals will continue as many of these groups have lagged last year. Small caps stocks are well-positioned to be the high-growth cyclicals in a strengthening economy.

Higher Taxes To Pose Limited Risk

A risk often cited to the 2021 economic growth is the fear of higher taxes which can potentially decelerate the economy or make it reverse course. Tax cuts are indeed beneficial to corporate earnings. But tax cuts don't appear to have a meaningful or even a long-lasting impact on economic growth. In fact, the tax-cut fueled economic growth model may be somewhat overrated. It has usually under-delivered in economic growth at the expense of ballooning fiscal deficits. Fiscal spending, particularly when it's targeted, can deliver a more lasting impact on economic growth.

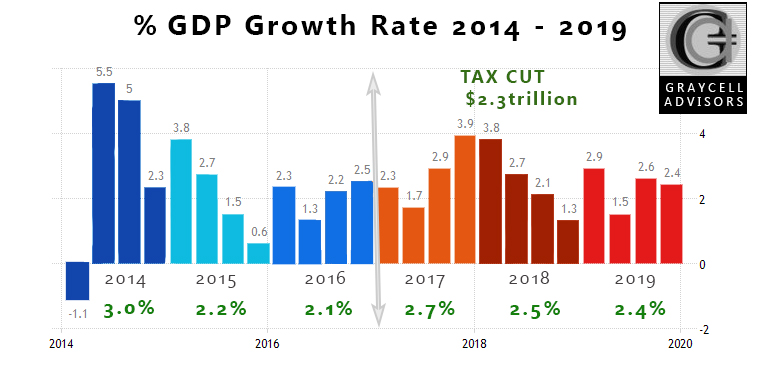

A recent example of the failure of a tax-cut stimulus to deliver a durable upward shift to the economic growth curve was in 2018. The $2.3 trillion stimulus from tax cuts during the Trump administration had a short-term impact. Average economic growth over the first 3 years of Trump Administration, prior to the pandemic, was not much different when compared to the final 3 years of the Obama administration when taxes were higher and there was also no boost from a fiscal stimulus.

GDP Growth And Tax Cuts

The green annual GDP growth rates are the average of the quarterly growth rates, and they are in the same 2% to 3% range for the 6-year period. Tax cuts did not deliver the consistent and robust long-term economic growth that was being projected. The impact of tax cuts was short-lived and mostly in just the last two quarters of 2017 when they were announced and legislated. The tax cuts went into effect in 2018 and GDP growth retreated sharply thereafter.

It would appear that fiscal stimulus, like the one during the Great Recession, can be more effective in prolonging growth, and targeted ones, like a potential infrastructure plan, could be even more so.

Economic growth will not be derailed with a rise in taxes to pre-2018 levels and should be offset in economic impact from the ongoing fiscal stimulus.

Risks

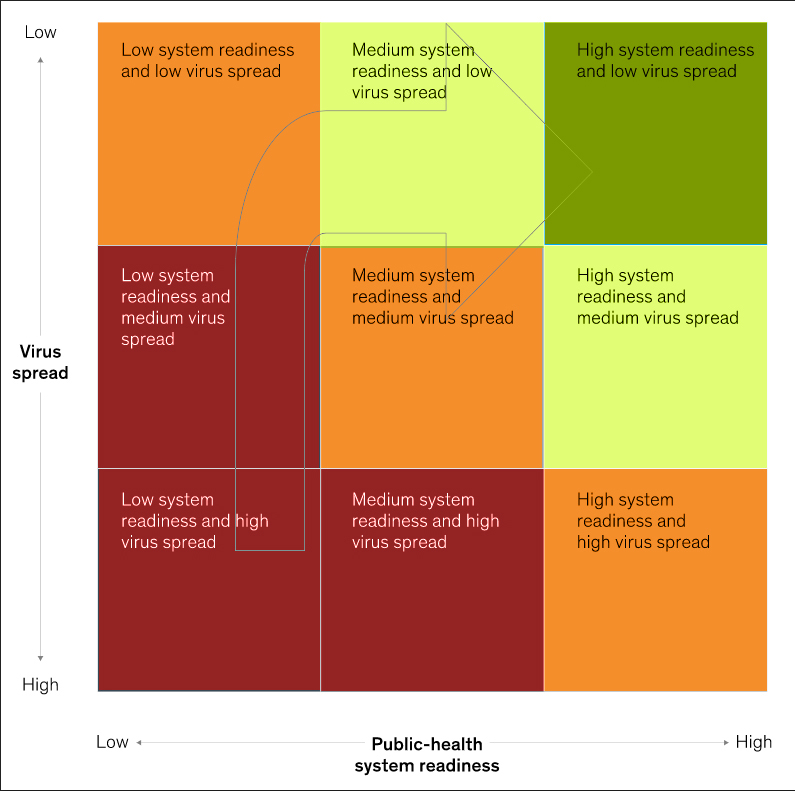

Bull markets also have sharp pullbacks, and small caps are not insulated. We believe the biggest overall risk to be a continued botching up of pandemic management. With the vaccine rollout thus far being a failure of planning and implementation, there is a real cost in terms of economic growth if the new administration also flounders with a disjointed strategy.

Each month the surge in economic growth is deferred, particularly beyond the second quarter, it exposes the stock market to a sharp correction. There will be times when tactically reducing the exposure may be best, based on the investment approach. The first such moment can occur in late January and February as the earnings season unfolds, at a time when the resurgent pandemic may push companies to tone down the first-quarter outlook.

Outlook

If one is betting on economic growth, then it is hard to overlook small caps. After years of underperforming, 2021 can likely be their year for more reasons than one. And over the last decade, small caps may not have faced a better environment than the one they will be part of from this year onwards.

At a technical level, small caps are starting this year after breaking out from a two-year consolidation period, while fundamentally they are going to benefit from stronger economic growth, particularly in the second half and beyond. This positions the small cap segment to build strongly on the modest gains of 2020. In an early stage of a bull market triggered by a new economic expansion, the best gains come in the first years when earnings surge and there is the least resistance to an uptrend. We anticipate the premier small cap index, the Russell 2000, to gain 20% in 2021 and possibly higher.

There will a significant pool of promising opportunities in the small cap and early midcap segments. A few such promising companies, some of which may be now or in the past part of our Prudent Small Cap, the Prudent Biotech or the Prudent Healthcare model portfolios, include Celsius (CELH), Digital Turbine (APPS), Clean Energy (CLNE), Avaya (AVYA), Plantronics (PLT), Upwork (UPWK), Domo (DOMO), Veritone (VERI), Brinker (NYSE:EAT), BJ's Restaurants (BJRI), SunPower (SPWR), eXp World (EXPI), Jumia (JMIA), TG Therapeutics (TGTX), Trillium Therapeutics (TRIL), InMode (INMD), and Scholar Rock (SRRK). This is just a short list.

Small caps represent a riskier segment of the market and investors should have a concrete investment strategy to manage the risk. A portfolio approach should be preferred by investing in a basket of promising companies that can assist in managing risk and overcoming mistakes.

The article was first published on Seeking Alpha