Market Pulse

The small-cap stocks have finally stirred.

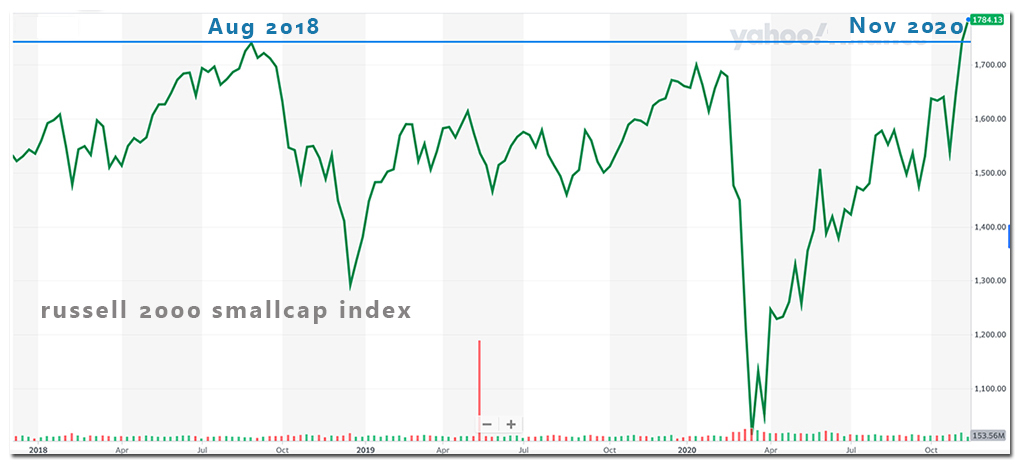

The Russell 2000 Index (IWM), a key benchmark for small-cap stocks, has been the rare major index that has not recorded a recent new high. The last one was recorded back in July 2018. After over 2 years, the index finally achieved that elusive milestone, as it rallied to an all-time high this month. The sharp rally this month has also boosted the index finally into positive territory for the year.

Economically Sensitive Stocks To Lead The Market

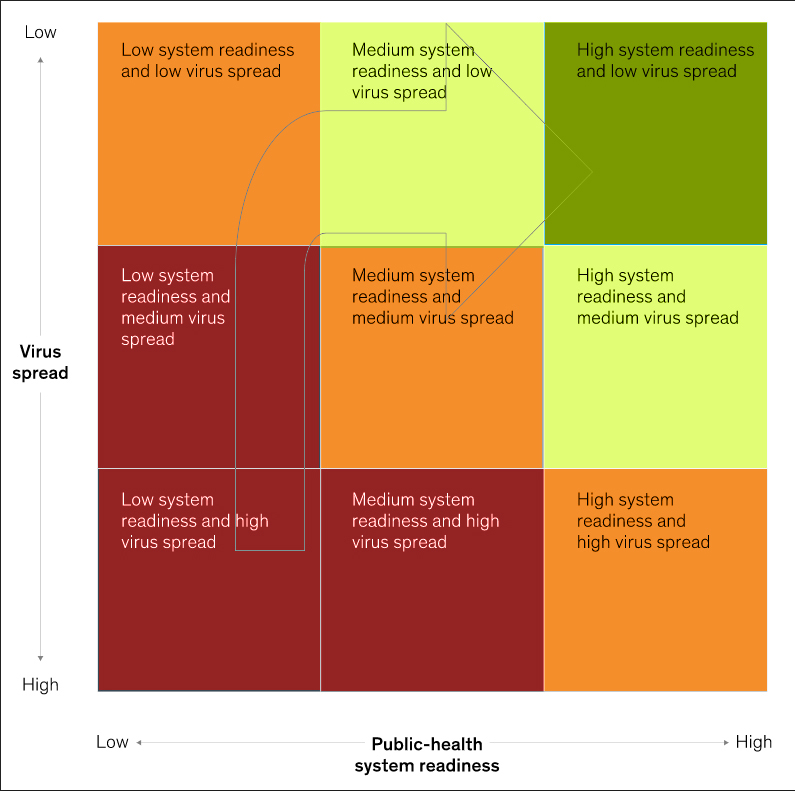

The renewed vigor in small caps is the result of an expectation of more consistent economic growth next year. The potential availability of vaccines and treatments early next year, and a new administration with a greater emphasis on a national pandemic strategy, improve the odds of overcoming the disease rapidly and delivering a more sustained and sharper economic recovery next year. What is good for the US economy is good for small caps - a market segment that is quite sensitive to the economy.

As the economy improves, the small caps have significant potential for earnings growth, just like the larger-caps have begun to experience, particularly in the technology sector. During the third quarter, the earnings picture brightened sharply for larger caps in the S&P 500 (SPY), with earnings beats more widespread amongst industries and not just limited to the technology mega-caps, like Microsoft (MSFT), Google Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), and Facebook (FB). Analysts are already raising the S&P 500 estimates for the fourth quarter, as per FactSet.

Risk-Appetite Will Only Grow,

Making It Harder To Ignore Small Caps

Small-cap stocks have surged this month, after lagging significantly for the entire year.

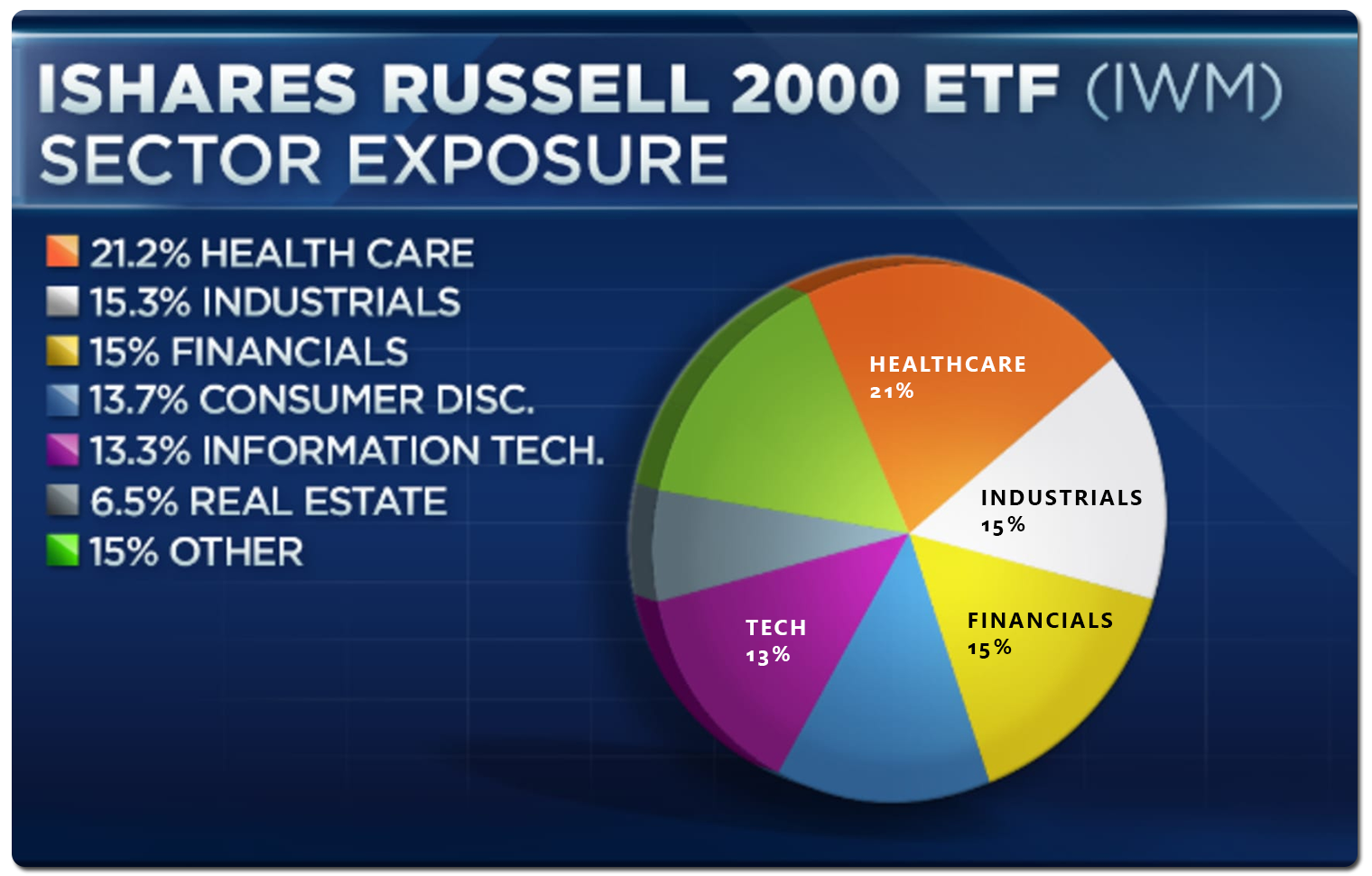

This broadening participation behooves well for the stock market. The Russell 2000 Index has less weightage towards technology, at about 13%. This is far less than the larger indexes like Nasdaq (QQQ), where the TMT group accounts for over one-third of the market cap weightage, and the S&P 500, where the top 5 market cap companies are all technology ones. So, with small cap joining and leading this month, that broad momentum thrust, beyond technology, is a positive for the overall market.

As pandemic-related uncertainty begins to diminish next year and earnings growth resumes, it will continue to boost investor risk-appetite. This will help speculative segments of the market, like the small caps and biotechs, even more. With growing economic confidence, there is likely to be a persistent rotation into stocks, sectors, and segments that have underperformed this year due to earnings risk and economic turmoil.

The early years of an economic recovery are particularly good for economically sensitive segments, like the small caps, due to greater earnings momentum. Based on the potential for sharp and steady growth that builds up each quarter during 2021, small caps should not be ignored and can be a rewarding addition to a portfolio mix. The growth stocks in the Russell 2000 Index have led the advance this month, outperforming the S&P 500 and breaking above its long-term technical resistance.

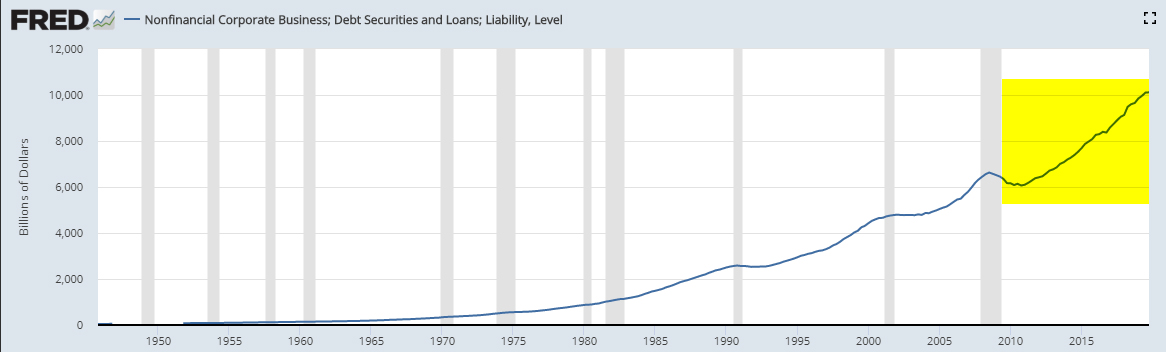

The expansion of Federal Reserve's Main Street Lending Program to reduce loan sizes for small businesses, and a potential Federal stimulus, are major positives for small-cap companies.

At the beginning of November, the Russell 2000 Index was down over -6% for the year. Our Prudent Smallcap model portfolio was up close to +20% for the same period.

The sharp rally of the broader market this month, following the Presidential elections and positive vaccine news, has overextended the broader market. This overbought situation can possibly turn volatile over the next few weeks as it resolves itself. Also, a major risk to the market remains the unsettled stimulus package, and potential for disruption, either economic or political, by the outgoing administration as it delays an orderly transition. A glimpse of it was seen as the Treasury, after the election, is interpreting the Congress guidelines on emergency lending to businesses more harshly, and has decreed for the Federal Reserve to return the unused money by end of this year.

However, beyond such near-term volatility, small-caps are well-positioned for a strong performance in 2021 as a durable economic recovery takes hold. There are many promising small-cap ideas. A few of them listed below, which may be now or in the past part of our model portfolios, include Celsius Holdings (CELH), Upwork (UPWK), Digital Turbine (APPS), SunPower Corp. (SPWR), Pacific Biosciences (PACB), Kura Oncology (KURA), Celldex Therapeutics (CLDX), eXp World Holdings (EXPI), Brinker International (EAT), Jumia Technologies (JMIA), Replimune Group (REPL), Trillium Therapeutics (TRIL), TG Therapeutics (TGTX), Kodiak Sciences (KOD), CarParts.com (NASDAQ:PRTS), Plantronics (PLT), Invitae Corp. (NVTA) and Natera (NTRA).

Industry exposure can also be quickly acquired through ETFs like the one tracking the Russell 2000 Index (IWM) and another tracking the S&P SmallCap Index (IJR). Smallcap investing is volatile and high-risk. Investors should pursue a concrete investment strategy, preferring a portfolio approach by investing in a basket of promising companies that can assist in managing risk and overcoming mistakes.

The article was first published on Seeking Alpha.