Small Cap Stocks 2024 Second Half Outlook

Small cap stocks struggled in the first half of 2024 due to economic concerns and higher interest rates, lagging behind broader market indexes.The outlook for small caps in the second

Small cap stocks struggled in the first half of 2024 due to economic concerns and higher interest rates, lagging behind broader market indexes.The outlook for small caps in the second

Small cap stocks surged in the final two months of the year as the 10-year yield reversed direction.The Fed's actions in 2024 will determine the prospects for small cap stocks,

The Federal Reserve's Open Market Committee offered the possibility of three rate cuts next year, driving stock market indexes to new highs.The Fed's outlook has pivoted towards market expectations, with

Market awaits Federal Reserve's decision on future rate cuts, with expectations rising for cuts in March and May.Fed is cautious about signaling a shift to less restrictive policy due to

The Federal Reserve paused rate hikes after 10 consecutive increases.Fed's projections indicate two additional rate hikes are possible.The market has been resilient and continues to trend higher after the meeting,

The Federal Reserve raised interest rates by a quarter point to manage inflation, but faces a conundrum.The Federal Reserve has opened a new short-term loan facility to address a liquidity

The unfolding banking crisis has been shaking financial markets and contributing to a negative tone in the stock market.Recession risk has risen as the banking crisis envelops more banks.The Federal

Small caps outperformed the Nasdaq Composite last year as stocks fell due to the Federal Reserve's efforts to control inflation.Market fears are mounting that the economy may slip into a

Interest rate policy is getting closer to a step-down.More Federal Reserve officials are focused on the risks of sharply rising rates.Inflation can fall rapidly next year due to the lagging

Bear markets bring into focus the inevitability of portfolio drawdowns.Drawdowns are more common than investors realize.About two-thirds of the time a portfolio will be in a drawdown state, referred to

The Federal Reserve continues to talk-up its resolve in taming inflation.While a 75 basis point increase is baked in for late September, it is likely that the November meeting brings

An economic rebound in 2021 should benefit small-cap companies.Monetary and fiscal policy alignment to boost economic growth.Small-cap stocks can be the high growth cyclicals and outperform after lagging in 2020.A

Small caps finally record a new high after two years and turn positive for the year.Vaccine progress is raising expectations of a more robust and durable economic recovery in 2021,

Stocks to move higher irrespective of Presidential election outcome.Prominent near-term risk is of a contested election.If polling lead stays steady or widens, stocks to respond positivelyStocks are well-placed to have

The market remains unsettled but is moving higher as it expects good things to happen after the hot spots peak.The impact of the pandemic will keep expanding deeper into the

A deliberate slowing down of the economy is in progress in order to preserve it.The key question remains how soon can we start recovering.The expected $2 trillion stimulus package will

Unexpected tariffs catch the market by surpriseSharp selloff accompanies escalating trade conflict with ChinaWhile the negative consequences of rising trade friction are significant, there are a couple of positives which

The Zero Spread is providing a signal of the building risk of an economic recession. A substantial lag exists between yield curve inversion and a recession, and a key

Intense volatility in the final quarter eroded double-digit gains last year Fears of a recession or a sharp economic slowdown in 2019 are inconsistent with data and most likely

Stock market indexes and sectors have slipped 20% to 40% from their highs. But the economy is heading for moderation, not a recession. The bear market has been created

Halloween is coming, but the goblins seem to have already arrived and lost their way into the stock market. And they're creating havoc! The relentless volatility and a drip of

While much attention is being riveted on the S&P 500 new all-time high eclipsing the January one, small cap stocks accomplished that in May. Small cap stocks are in

Earnings fountain created many opportunities in the first-half, even though index returns were relatively restrained. During the first-half, the market overcame a tide of negative sentiment, including a breaking

The stock market is volatile but still rewarding Most investors should favor a longer-term time frame as the stock market again records new highs after recovering from the first quarter

Small cap stocks record fresh all-time highs leading the broader market indexes higher for the first time in a couple of years Small cap performance suggests an underlying risk

Stock market volatility is disruptive but has not damaged the markets Key supports remain favorable for the primary uptrend Growing political risk is a bigger threat to the market

Stock market gored by a sharp spike in yields. Rising inflationary expectations feed into the fear of an aggressive monetary policy beyond current expectation. A cyclical adjustment as we

Stocks remain in a major uptrend. Staying the course worked great in 2017 and remains an effective strategy even now. Witnessing a renewal of business cycle expansion, which can

November 14, 2017 We can be irrational investors and have to be aware of our biases. Investing biases can cost us significant returns over time. Group Thinking, Loss Aversion, and

November 07, 2017 Systematic Investing, using quantitative models, continues to grow as it addresses key drawback of active investing - behavioral biases Behavioral economics continues to provide growing evidence of

October 10, 2017 After a sleepy start, small cap stocks have turned up the heat. Corporate tax cut proposal triggered the rally. The enduring power of small cap relative outperformance

September 29, 2017 Yellen remains steadfast on the interest rate path Stock market takes the higher probability of December rate rise in its stride The health care repeals effort fizzle

September 19, 2017 Federal Reserve begins an important meeting on Tuesday with implications for the stock market Start date for the Balance Sheet Rollback program to be announced Federal Reserve's

August 30, 2017 Entering a period of elevated risk from unrealized policy expectations, budget ceiling debate, and Federal Reserve's quantitative easing reversal September and October are the months to be

Monetary policy became more aggressive last month with the announcement of the balance sheet normalization program Emerging evidence now points to a willingness to reconsider further rate increases based

June 29, 2017 Market fundamentals remain stable with earnings momentum and a steady economy Monetary policy experiencing a material change as the Federal Reserve outlined a program to reverse quantitative

May 16, 2017 Controversies are now typical of the new Trump administration. In spite of jolting political news, the market remains in a steady uptrend. Earnings and growth trump

April 26, 2017 Market professionals are suggesting an imminent correction for some time. Key measures are indicating overvaluation. But the market still marches on. Market Timing is a costly exercise,

March 24, 2017 Brilliant professional money managers fail in their market timing. For individuals it is even harder to engage in market timing. An eye on the three key supports

Buffett's Recent Investments Suggest Confidence In Economic Growth. The Economy Has Legs and So Does the Market. Uninterrupted Market Rise Raises Probability of A Normal Pullback. Even Though March

February 08, 2017 A change of administration typically means new policies that impact economic growth The first two weeks of the new administration have been fairly controversial The stock market

January 22, 2017 Small Cap stocks had a strong 2016 after a slow start The enduring power of Small Cap performance over years should factor into portfolio decisions Investors must

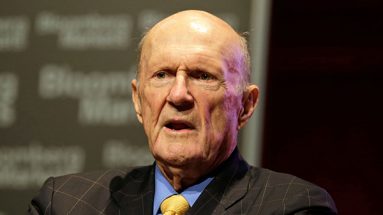

January 18, 2017 Steve Cohen is one of the most successful hedge fund managers of the last 25 years. His firm, Point72 Asset Management, had a difficult last year as the

December 20, 2016 Investors have been fairly cautious in the second-half, with money managers and analysts predicting an imminent correction. All key constructs of stock market valuation have continued to

Drawdowns are inevitable and more common than investors realize. Nearly two-thirds of the time a portfolio will be in a Drawdown, referred to as a State of Regret. Nearly

November 11, 2017 Economy and earnings can't be ignored. Monetary policy remains accommodative. Investor sentiment has improved markedly towards assuming risk in stocks. Higher stock prices and new stock market highs expected It may be instructive to keep

November 5, 2016 The stock market begins to factor in a non-Clinton Presidency. Late momentum allows Trump to close gap with Clinton, forcing the stock market to recalibrate. A spurt

November 1, 2016 Earnings are coming in better than expected by the stock market, with the S&P 500 companies reversing an over year-long decline during Q3 itself. The final hustle

October 17, 2016 Recently, Robin Wigglesworth of Financial Times wrote an interesting article about some automated systematic investing strategies being pursued by institutions that add to the volatility in the stock

OCTOBER 13, 2016 Attention shifts from US elections towards earnings Third quarter earnings to be supportive of stock valuations Monetary policy to assume greater importance later in November Uptrend remains

SEPTEMBER 29, 2016 Julian Robertson, a legendary hedge fund manager who founded one of the most successful hedge funds, Tiger Management, noted in a recent Bloomberg interview that the industry faces

SEPTEMBER 23, 2016 The case for staying the course with stocks was bolstered following the FED's ongoing pause. As earnings season arrives, technology to power Nasdaq Higher. October can see

SEPTEMBER 21, 2016 Investors are not rational and have to deal with biases. Investing biases can cost us significant return over time. Disposition, Confirmation, and Anchoring are few other biases

SEPTEMBER 17, 2017 Investors are not rational and have to deal with biases. Investing biases can cost us significant return over time. Loss Aversion, Confidence, and Bandwagon are few of

SEPTEMBER 13, 2016 Federal Reserve to shift out any monetary policy change to December or beyond. A pre-emptive increase can turn the intended medicine to poison. Volatility to remain elevated

SEPTEMBER 12, 2016 This recent headline on Bloomberg caught my attention. "There's a Simple Reason Why UBS Is Hiring So Many Quants" The Swiss financial giant UBS Group, which oversees nearly $2 trillion, has

SEPTEMBER 09, 2016 Most Active Managers Are Unable to Outperform benchmark S&P500 Small-cap managers face an even more uphill battle with 90% underperforming S&P600 There is room to consider model-based

AUGUST 9, 2016 Markets have overcome systemic shocks to record all-time highs. Rally has begin to shift towards being earnings-driven as well, rather than being interest-rate driven. September could be

JULY 14, 2016 Small-cap stocks have risen strongly from their February lows Risk appetite remains strong, and portfolio exposure to this dynamic segment is prudent Favorable Fed policy and signs

JUNE 30, 2016 Interest Rates to Remain Lower for Longer Economic Growth was Stronger in Q1 than Expected Even though Brexit Puts Pressure on Global Growth, How Much and When

Federal Reserve will update its “dot plot” to reflect the median rate hikes for 2016, and that number is widely expected to come down to 3 from 4 A

We anticipate the market decline to provide fresh legs for a new rally later in the first quarter and early second quarter For the year, we anticipate a positive

SEPTEMBER 16, 2015 The market expectation we laid out in our January 2015 commentary and reiterated in April 2015 second quarter commentary was borne out from late-June through August. As

Small cap stocks underperformed significantly during 2014, compared to larger caps. As the US economy strengthens while key international economies struggle, small caps are well-positioned. We anticipate small caps