Market Pulse

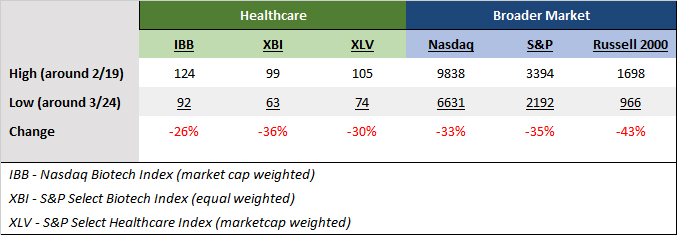

This week all the major indexes made new lows. The market continues to be under stress and this is not the final low. Biotechs were one of the few industry groups that didn't make a new low this week. A respite from non-stop selling will come from the economic stimulus package which can serve as a floor for stocks at least in the near-term. The extreme oversold levels can boost the rally, although a meaningful rally may be seen as an opportunity to liquidate as well.

A Comatose Economy

The economic situation is truly unique. This is not a typical business-cycle slowdown. It is not correct to even refer to it as a slowdown. It is a deliberate lock-down of the US economy to meet the public health objectives. A comatose state is being induced in the economy in the hopes of preserving it.

The stimulus package is a misnomer for we are not even aiming to stimulate the economy and jump-starting demand. On the contrary, we are pulling labor out of the economy to bring it to a halt. This is more aptly described as an economy preservation package to raise the probability for businesses and employees to survive and tide-over the near-term disruption from a hibernating economy. If successful, then hopefully most of the small-to-medium size businesses and large corporations will avoid bankruptcies and, very important, people will have jobs to return to eventually. This is critical to preserving the economic fabric and ensuring a robust recovery down-the-road.

A $22 trillion economy will need this $2 trillion support package to maintain it in an idling state. The amount of fiscal funding washing into the economy will greatly assist in preserving a major portion of our ability to bounce-back. Even though the support benefits cannot make businesses and people completely whole, they do soften the blow. Also, the safety net is broad with expanded and extended unemployment insurance at 100% of lost wages. But it's also quite likely that with every passing month in lockdown the need for additional packages will rise.

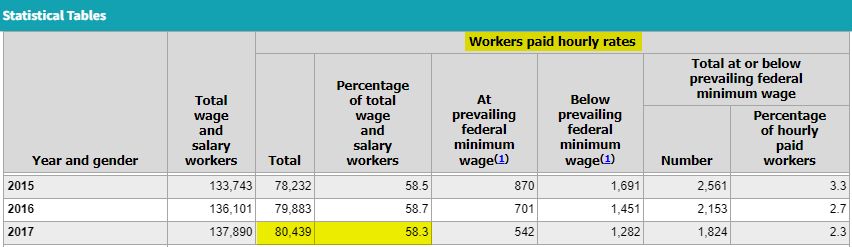

The economic numbers are going to be bad. That's obvious. Unemployment claims last week were the highest in recorded history. The unemployment rate will be sharply higher, perhaps even in double digits already for March. In 2017, the Bureau of Labor estimated over 80 million workers as being paid at hourly rates. This represented over 58% of the workforce. Needless to say, this pool is under tremendous stress and that will be reflected in the numbers.

Consumer spending, which powers a bulk of the economy, will show a plunge. The economic statistics that will be released during this crisis possess shock value signifying the depth and scope of economic retreat.

But these numbers are meaningless and cannot be compared to a normal business cycle environment a year ago.

Consumer spending, which powers a bulk of the economy, will show a plunge. The economic statistics that will be released during this crisis possess shock value signifying the depth and scope of economic retreat.

But these numbers are meaningless and can't be compared to a normal business cycle environment a year before.

A Struggle To Resume

An event-driven crisis requires immediate monetary and fiscal response. The Federal Reserve in a brilliant series of swift actions has cut rates to zero and continues to intervene with the full power of its limitless balance-sheet to maintain functional credit markets.

Such a crisis also requires massive federal spending spree. The $2 trillion stimulus package will awash the economy, both consumers and businesses, with near-term liquidity. It will not offset the entire economic damage, but it will contribute significantly to preserving the economic ability to bounce-back. We are indeed fortunate that the fiscal package significantly addresses a major shortcoming of the Great Recession stimulus package when Congress approved an $800 billion plan, due to untimely strident cries for fiscal responsibility, that was woefully insufficient thus prolonging the suffering for millions and slowing-down the recovery.

With the above two critical elements in place, the key question that remains is when can the economy resume its operation. The economy cannot be revived until the public health issue is resolved.

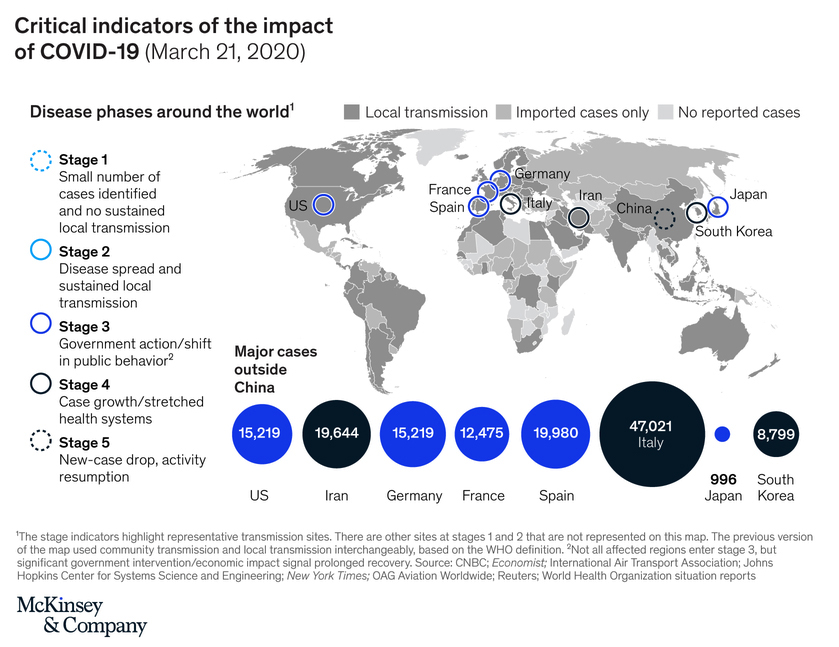

Mandated shutdowns are spreading across the country, and these are unavoidable as the opportunity to control the outbreak was lost due to the lack of focus and inadequate testing ability. Without both, containment was never a viable strategy. South Korea and the US had the first case detected on the same day. The US is woefully unprepared for a pandemic as was clear from the Crimson Contagion official document, revealed last week, of a pandemic preparation exercise in Oct 2019. The country's ability to shorten as well as limit the crisis is compromised and most of the country will have to pursue a mitigation strategy.

Many coastal states are in mitigation mode and shut-downs are vital to that strategy. Besides, new hotspots will continue to emerge as the virus makes its way in from the coasts. It's misguided to claim that many states in the interiors don't have an issue, for it's the same kind of statement that was being made about the entire country ~3-weeks ago. If you don't test in numbers, you will never find out the scope of the problem. Testing is lagging in many states as the focus has been on existing hotspots. Thus, the ability to contain the virus in those unaffected states will diminish which will then have to resort to harsher mitigation strategies.

When Can We Resume?

In our opinion, the answer to the question lies as much in diminishing the viral threat as it is in preparing the population psychologically to resume, where it has the confidence to begin a normalized routine.

It will become a two-front battle for both the health and the minds of the people. During May, the battle for the mind will assume greater weight as the population will need a reassuring confidence boost against the pandemic. The economic revival may not be as straight forward an exercise as simply telling the workforce to resume normal operations.

Consumer confidence can grow from the data that shows the trend is changing, and from the encouragement of credible influencers who have been leading from the forefront.

In the battle for the minds, statements that urge getting back to work now and elderly citizens should be ready to take a hit for the sake of the future of the economy, are misguided for they, (a) erroneously localize the risk solely to the 60+ demographic, (b) are made by public leaders who will always have preferred access to the best healthcare and a ventilator, never run the risk of being triaged-out, and much lower risk of acquiring the infection due to their cloistered and sanitized environment, and (c) fail to recognize that you cannot edict or urge people to get back to work unless they believe it is in their best interest.

The entire focus now has to be on continuing to rapidly expand testing where anyone in the country with symptoms can get tested, not just rhetorically but actually. That is likely to occur across the country by mid-to-late-April. Testing has obvious benefits for mitigation, but also significantly boosts public confidence. Anti-viral drugs are being tested expeditiously and if there are early positive breakthroughs in April and May, that can add to public confidence.

Finally, if a peak in new cases is achieved in the worst-hit areas, it begins to suggest that the regional overload on hospital capacity will start to subside. This will be a significant confidence booster. Most likely late in the second half of April, one can begin expecting such news from the early-hit hotspot states.

What Is The Public Health Goal?

At some point over the next 45 days, as sufficient testing scale will be achieved and peaking in hotspots would have occurred, the economic risks to continue with a lockdown can perhaps begin to outweigh the public health risks of the outbreak.

Immunity cannot be achieved until we have either suffered the virus or have been vaccinated, which at best will be next Spring 2021. And hunkering down for that long will invite economic ruin.

Then what is the public health goal we are aiming at?

Any decision to rev up the engines of the economy will have to be balanced with the risk of a relapse. Perhaps the issue can best be framed as trying to achieve some form of equilibrium in this outbreak where the healthcare capacity is once again in a position to handle new cases. The risk of infection will continue to persist and people will have to modify and adapt realizing that all the sanitary precautions need to be maintained. But a big positive after a lock-down of more than 14-days is that there will be clarity on who is virus-free and who is infected. Such a sorting will allow for appropriate self-quarantine and create a major impediment to community viral transmission. This will strengthen the case for relaxing social-distancing guidelines on a regional basis.

The day that Americans begin to feel that if they fall sick they will have access to hospital care will be the day America will begin its journey back to work.

But to achieve that, it is our belief, a prerequisite may well be for the Federal government to begin underwriting all treatment costs of COVID-19 that the healthcare insurance does not cover as America gets back to work. It can be part of another stimulus package, this time to really revive the economy.

In our estimate, the point when America begins to resume work can occur in the second half of May.

Conclusion

The grand solution of putting an economy to sleep to battle the viral outbreak has been supported and strengthened by a $2 trillion federal government spending package. This significantly boosts the chance of preserving the workforce and businesses to tide over the disruption for at least the next 2-months. While it appears that we may be able to bounce back quickly, due to pent-up demand, this is a unique situation and one does not know if such idling can in the interim bubble-up stresses in other sections of the economy and reinforce the tendencies and grip of a typical recessionary environment. That would mean consumers become reluctant to spend as the fear of an economic crisis begins to dominate following the healthcare crisis, which itself may have a lingering fear of a resurgence again in the Fall and Winter in the absence of a vaccine. But we will be much better prepared.

While the temptation exists to participate in the sharp rallies that have ensued as a result of the stimulus package, it's premature to make judgments on a firm change of market direction. Investing becomes relatively safer with a much longer time horizon or maintaining higher cash levels during heightened uncertainty. The viral outbreak in the US will intensify further, as anticipated, and the coming weeks will reveal how much of the crisis is already factored in market valuations. Raising cash has been a preferred strategy in the treacherous market thus far. But after a deep selloff, some sectors are now better positioned and will present attractive opportunities for the second-half. In our recent articles, Healthcare Investing In A Bear Market, and What's Ahead For The Stock Market, we laid out in greater detail how healthcare is a relatively defensive industry and biotechs, in particular, can outperform in the existing environment. The model portfolios of Prudent Healthcare, the Prudent Biotech, and the Graycell Smallcap are presently 25% to 30% invested.

We would suspect the market would bottom-out sometime in April when even news that appears really bad doesn't move the market lower. The bad is already factored, and it's the good second-half that the market begins to look out for. But again, there is a lot of data between now-and-then.

Many healthcare and biotech companies will continue to have their businesses mostly intact and promising prospects ahead. A few of the larger ones which can be considered at an appropriate time include Gilead Sciences (GILD), Vir Biotechnology (VIR), Moderna (MRNA), Regeneron Pharmaceuticals (REGN), Momenta Pharmaceuticals (MNTA), Vertex Pharmaceuticals (VRTX), Acceleron Pharma (XLRN), Collegium (COLL), Luminex (LMNX), Karuna Therapeutics (KRTX), Zai Lab (ZLAB), Kodiak Sciences (KOD), Neogenomics (NEO), Seattle Genetics (SGEN), and Biogen (BIIB).

The article was submitted on March 25 to Seeking Alpha.