Small Cap Pulse

Small cap stocks faced a challenging environment in the first half of 2024, burdened by concerns of an impending economic slowdown and higher interest rates, similar to the issues encountered in 2023. While economic growth has slowed, it has remained positive. Second-quarter GDP numbers are expected to be stronger than the first, but persistent fears have restrained small cap performance.

During the first half of 2024, small caps lagged behind broader market indexes, which reached new highs. The Nasdaq (QQQ) and S&P 500 (SPY) indexes increased by 18% and 15%, respectively. Conversely, the Russell 2000 Index (IWM), the most widely used small cap benchmark, rose only 1%, and the S&P Small Cap 600 Index (IJR) slipped by 1%. The Prudent Small Cap model portfolio performed better in this difficult environment, rising 36%.

The outlook for small cap stocks in the second half of 2024 could improve if interest rates are cut in a timely manner and economic growth remains stable. This scenario would be ideal for a small cap rebound. However, the upcoming weeks may be challenging as recent data indicates a weakening economy, and the approaching earnings season may reveal the stress of higher rates in lower guidance.

This report is a follow-up to our 2024 outlook published in January.

The Interest Rate Dilemma

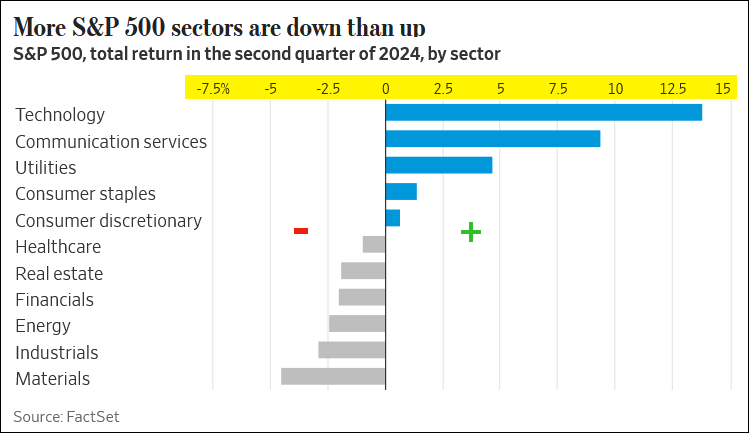

The underperformance of small caps reflects a split market where a few large technology companies propelled the Nasdaq and S&P 500 indexes higher, while many companies struggled or lost ground. According to a recent WSJ report, more than half of S&P 500 companies have declined since early 2022, with more sectors down than up in the second quarter.

For many sectors and market segments, including small caps, restrictive interest rates are a key factor affecting valuations. Thus, discussing the prospects for small caps inevitably involves examining the outlook for interest rates.

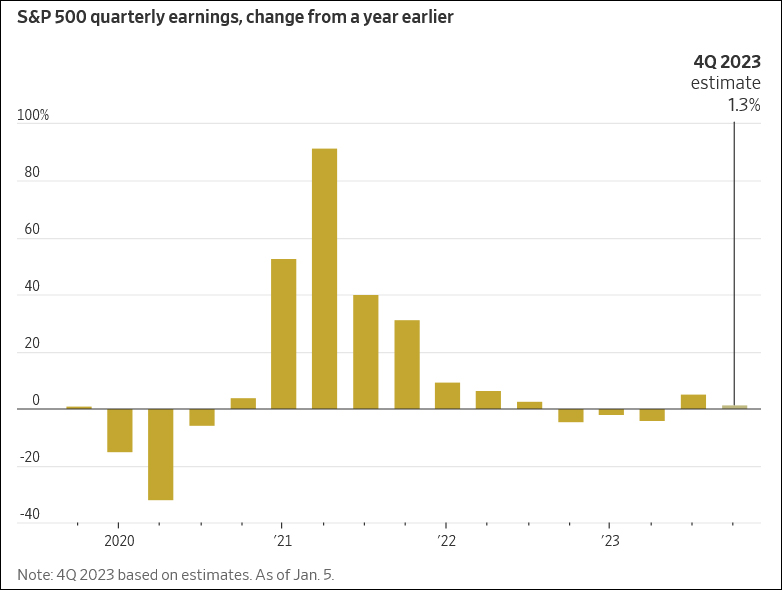

The market is seeking a rate cut driven by progress in reducing inflation, creating a "goldilocks" scenario of growth and lower rates. However, a rate cut resulting from an economic slowdown would be detrimental to stocks.

The market will closely monitor the second-quarter earnings season for guidance and third-quarter economic data for signs of a sharp slowdown. The hope is that the Fed will act in time to prevent a downturn. The timing of Fed action is crucial for the prospects of small caps and the broader market.

Interest Rates Will Fall, And Soon

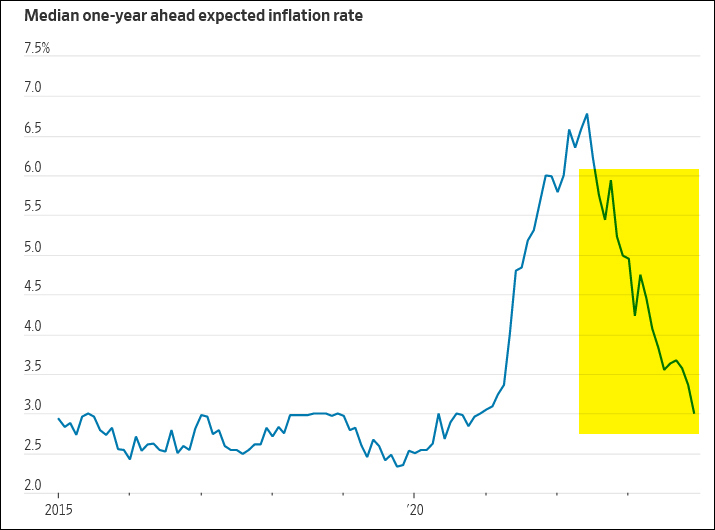

We expect the 10-year yield to fall in the coming months, reflecting progress on inflation and signs of slower growth. Upcoming inflation readings, particularly over the next three months leading to the September Fed meeting, should show consistent progress, as indicated by the recent CPI report. We had discussed such an outcome in our recent report on Biotech Outlook.

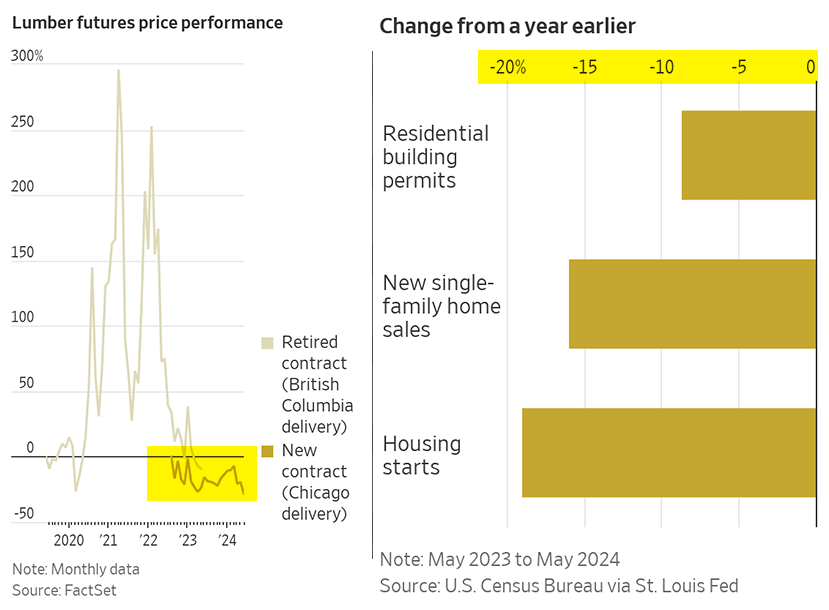

More than 50% of CPI index components are growing at pre-pandemic rates. The new home building sector is under stress, with lumber prices down 27% since mid-March, and residential construction sliding.

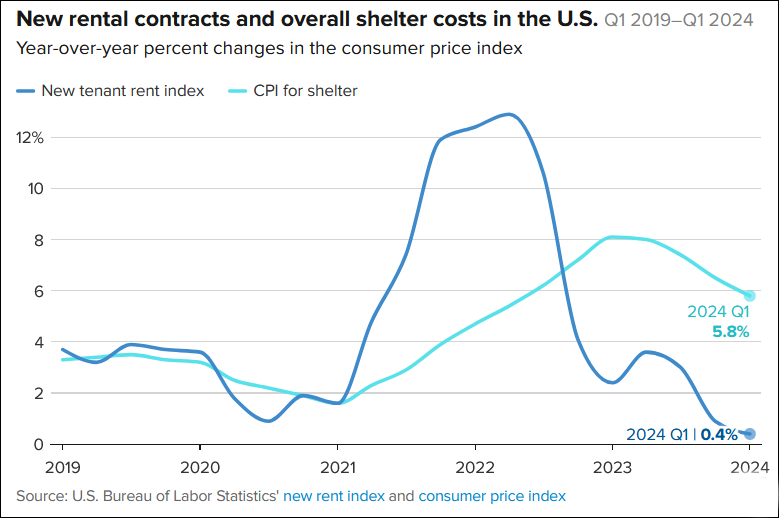

Housing, accounting for over one-third of the CPI, has responded slowly to disinflation within its components. However, housing starts and costs are declining sharply, and rents are now rising slower than the pre-pandemic rates, indicating economic cooling in this significant segment of the economy. Overall shelter costs are falling at a slower rate due to the way housing indexes are calculated, but they will inevitably decline more rapidly in the months ahead.

The unemployment rate has trended higher over the past three months, signaling an upcoming slowdown in economic activity. Wage growth's contribution to inflation decreases as tight labor market conditions ease, indicating economic normalization.

Even a gradual but consistent shift in the labor market can adversely impact economic activity, sufficient to push treasury yields lower.

The Fed is now positioned favorably to support a rate cut, with slowing economic growth, job growth, and inflation. It is increasingly difficult to justify a Fed Funds range of 5.25% to 5.50% when PCE inflation is 2.6%.

Given the current conditions and milder inflation data this month, the Fed can hint at an upcoming rate cut in its July meeting.

What Does This Mean for Small Cap Stocks

In The Second Half?

Small cap stocks are in a challenging environment, bearing a greater burden from higher rates when compared to larger cap stocks. This sensitivity to economic concerns has resulted in higher costs paid in terms of equity valuation for small caps.

Interest Rate Cuts: Rate cuts are anticipated, but will they arrive soon enough to trigger a strong rally in small caps this year? We believe that with a rate cut expected in September, small caps could perform well in the third quarter. However, risks include a faster-than-expected economic slowdown or the Fed deciding not to cut rates in September.

Fed's Stance: Chair Powell's recent congressional testimony hinted at upcoming rate cuts, emphasizing the economic costs of delaying such actions.

Successful Small Caps: Thus far, fast-growing profitable companies or those nearing profitability in rapidly expanding markets have thrived. Once a rate cut occurs, investors can also consider unprofitable companies with strong 2025 revenue growth potential as they pose limited near-term earnings risk due to no earnings, and benefit from lower rates which reduces financing costs and enhances valuations.

Market Rotation: Growing expectations for the first rate cut will drive a rotation from large technology companies, with already expanded multiples, into the broader market, including small caps and biotechs, where the potential for multiple expansion is higher, as discussed in our last report.

Outlook: We anticipate a stronger third quarter for small cap stocks, aided by an easing Fed policy. We expect a Fed rate cut in September, followed by at least one more in November or December. A rally pause in October due to election uncertainty is likely, with a resumption in the final months. Key factors include Fed rate cuts and continued economic growth supported by these cuts.

What are IJR and IWM?

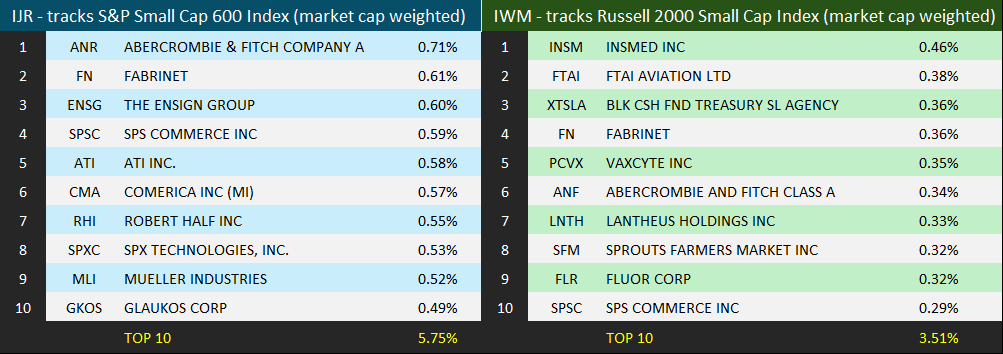

These are two small cap industry-focused ETFs that track their respective indexes and offer a way to acquire broad industry exposure, as the interest rate cycle changes.

iShares Core S&P Small-Cap ETF (IJR): This ETF tracks the S&P Small Cap 600 Index, which comprises about 602 small-cap U.S. companies. As of June, the median market cap was $1.8 billion, the average was $2.1 billion, and the largest holding had a market cap of $9 billion. The last closing price of IJR was $111.29.

iShares Russell 2000 ETF (IWM): This ETF tracks the Russell 2000 Index, measuring the performance of the 2,000 smallest companies in the Russell 3000 Index. As of June, the median market cap was $0.9 billion, the average was $4.5 billion, and the largest holding had a market cap of $47 billion. The last closing price of IWM was $213.14.

Below is a table of the top ten holdings for IJR and IWM, as of July 12, 2024.

Conclusion

In our January outlook, we noted that the first half posed risks for small caps, while the second half could be better. We believe small caps have an opportunity to rally in the second half as the environment turns more favorable with rising expectations of a rate cut in September.

Timely rate cuts can steady the economy and prevent a significant slowdown. The primary risk for small caps in the second half is data indicating a continuing slowdown without timely and frequent rate cuts by the Fed. Small caps in defensive sectors like healthcare can benefit from lower rates and be more resilient if economic growth slows.

We had anticipated a 15% rise in small cap indexes in our 2024 outlook, contingent on no slowdown and five rate cuts. We believe a 10% to 15% increase is still possible with one to three rate cuts this year.

In an environment of steady growth and an upcoming rate cut, investors will have a broader choice of attractive small caps. The ETFs of the S&P Small Cap 600 (IJR) and the Russell 2000 (IWM) offer diversified exposure, reducing the speculative risk inherent in the segment.

There are many promising small cap companies, some of which may already be part of the Prudent Small Cap model portfolio, including TransMedics (TMDX), Modine Manufacturing (MOD), Procept BioRobotics (PRCT), CECO Environmental (CECO), Aspen Aerogels (ASPN), CareDx (CDNA), Twist Bioscience (TWST), RxSight (RXST), Alpha & Omega Semiconductor (AOSL), GeneDx Holdings (WGS), American Superconductor (AMSC), Hims & Hers Health (HIMS), Vertex (VERX), Pulse Biosciences (PLSE), Axcelis Technologies (ACLS), Enovix (ENVX), Cellebrite (CLBT), and Redwire (RDW).

Investors should conduct due diligence and understand the risks in speculative market segments like small caps.

The article was first published on Seeking Alpha.