The clarity of election results next week is expected to lift a cloud of uncertainty, at least we all hope, and extinguish a significant political risk. That can likely set the stage for a market rebound, the extent of which depends on various scenarios.

However, if the election results end up in a contested state, a real possibility, and heads to the Supreme Court, that can cause significant volatility and perhaps take 5% to 10% off the market, based on the Bush-Gore precedent. But the risk of a contested election has continued to diminish as the polling gap has remained wide and steady. We will find out soon if the polls can be trusted.

Nonetheless, the market is recognizing the high-probability outcome.

It can be now Biden's time.

A Young Bull Market Meets

A Large Fiscal Stimulus and A Recovering Economy

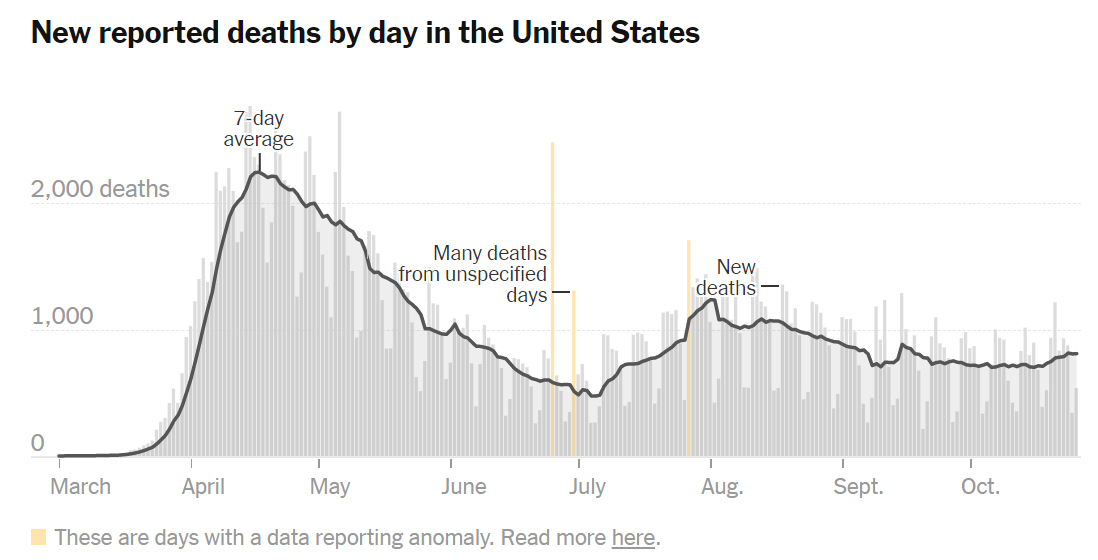

In all likelihood, the market in a week's time can get back to focusing on calibrating the pace of the economic recovery, which is now facing a significant headwind from a resurgent pandemic that is shattering previous peaks of daily infections from early Summer. At the same time, better treatment approaches and battle-tested medical experience will hopefully diminish the rate of fatalities amongst the infected population, and not cross the peak 7-day average of ~2,200 daily deaths back in April.

A Blue Wave

If a blue wave leads the White House plus the Senate into the hands of Democrats, giving one party full control of the government, it can create a materially positive market outcome. At least one, and likely more, multi-trillion-dollar stimulus packages - a jolt of high-voltage juice for a speedier economic recovery - would be forthcoming.

This will be the best-case scenario for a new bull market, where pro-growth fiscal and monetary policy are aggressively positioned to boost economic growth. It appears the market has reconciled itself to higher corporate and high-income taxes under the Democratic plan but views it as being much more than offset by increased government spending. In fact, higher fiscal spending is critical to repairing the frayed economic fabric. However, in a blue wave scenario, it is quite likely that the fiscal stimulus will get delayed till the end of January 2021.

It is also abundantly clear that economic growth will be jagged and unsteady until such time a national plan is rolled out on a war-footing to bring the pandemic under control, absent which, economic growth will be held back. As the last 7 months have shown, that is unlikely to occur during the present administration and more likely in a Democratic administration, based on the focus and policy plan put forth. This can further improve the chance for a steadier and stronger economic recovery in 2021.

A Red Wave or Status Quo

The probability of a Red Wave to handover complete control of the government to the Republicans is relatively low, based on current polling. If a red wave is to materialize, one would get a fiscal stimulus, most likely a smaller and final one, and more of the same ineffective approach to pandemic management. Taxes will remain the same. The stock market will rise and build further on gains in 2021, though held back by the volatile pandemic.

A status quo is a likelier outcome than a Red wave. If the polls are wrong this election cycle too and the status quo is maintained, then the market will still gain, though such gains will be restrained. Corporate taxes will remain the same, a plus, but unfortunately, so will the pandemic management effort. The President can aim for a somewhat bigger stimulus to get economic growth moving, and perhaps the Senate may sign-on as a victory tribute. But that will most likely be the end of large government spending that is going to be vital in 2021. More tax cuts will not be an effective strategy, as discussed below. The stocks will get over the disappointment of relatively lower fiscal spending, and focus on steadier economic growth in the second half of 2021. Stocks will rise, but the uncertainty of a ravaging pandemic and a fickle government response can hold back gains over the rest of the year.

One cannot help but wonder how well the present administration would have been positioned for a second-term if a more aggressive prevention strategy had been embraced. A consistent, honest, and forceful response would have boosted the probability of a second term, as the pandemic itself was an unavoidable event. The irony is that in the final election week, the pandemic that the administration often appeared to be dismissive about is now recording its all-time peak in infection rate, consuming the mind of the exhausted electorate just as it casts its vote.

A scenario that the market can consider much less than optimal is split control, where the Senate and the White House control is split between the two parties - the White House changes hands while the Senate remains in Republican hands.

This scenario will stall stimulus spending and very likely cause gridlock on priorities that are critical to managing the pandemic. A bitterly divided government simply prolongs the suffering from the pandemic and its economic devastation. This situation can be a serious disappointment from the investors' perspective, and the stock market can retreat and its gains over the next 12 months significantly diminished or non-existent as the economic recovery will be slower and uneven. Tax hikes may not pass, and neither will larger fiscal spending. The market can even sharply slip on such an outcome next week.

Fiscal Stimulus Was Already Needed

As Tax Cuts Only Boosted Short-term Growth

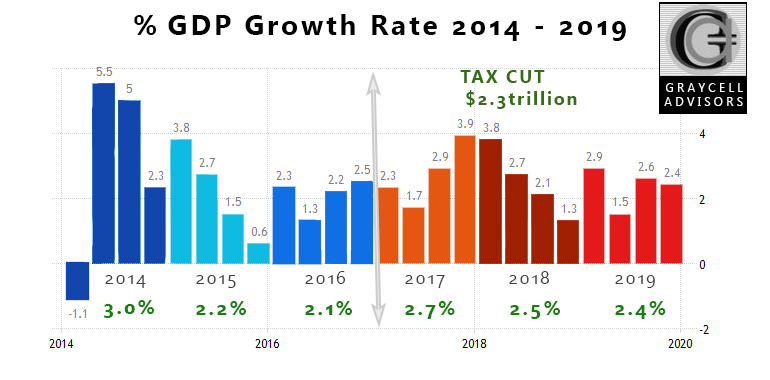

Economic growth was already under strain and slipping as 2019 ended, and before the pandemic even began. In fact, Q4 of 2019 recorded a 2.4% growth rate, which was a little less than the 2.5% rate recorded in Q4:2016, the end of the prior administration's tenure.

The chart below shows the economic growth from 2014 to 2019, avoiding the pandemic period, and covering 3 years each of the current and prior administrations.

A key data point to keep in mind when comparing the 2014-2016 period with the 2017-2019 period, as separated by the gray arrow, is that there was no stimulus package in the earlier period. The green annual GDP growth rates are the average of the quarterly growth rates, and they are in the same 2% to 3% realm for the 6-year period.

Tax cuts did not deliver the consistent long-term economic growth that was being projected, and in fact, the impact was short-lived and mostly in just the two quarters over which they were announced and legislated. GDP growth thereafter retreated sharply.

It would appear that targeted fiscal stimulus on spending plans, like the one during the Great Recession, can be more effective in prolonging growth. However, only one fiscal stimulus plan may not do it in this pandemic environment.

Investors To Face Growing Volatility Till Election Outcome, And Then A Stronger Market Scenario

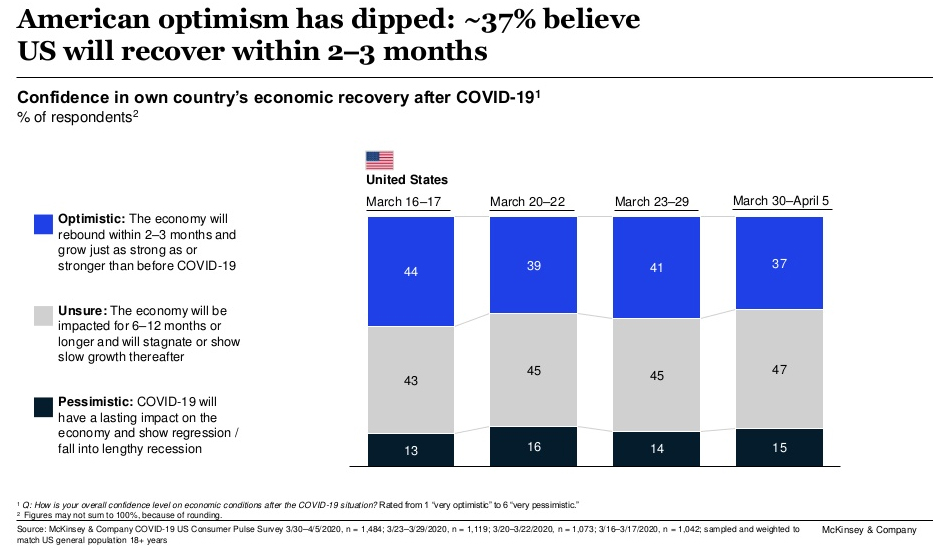

The pandemic is stalling the economic recovery and the soaring infection rate has reached crisis mode. It is hard to predict when it will peak, for Winter is just beginning. But perhaps over the next 30-days, this wave can peak in what is likely to be an undulating wave of infections through the Winter.

The power of a successful Presidential election cannot be underestimated in terms of the risk that fades away. In an earlier article, we had discussed in greater detail how the markets will rise irrespective of who wins the Presidential elections. Investors need to look beyond this volatile period to what can be a strong and consistent recovery, helped by the fiscal stimulus, and vaccines which can start becoming available in the first quarter of 2021.

Smallcaps and economically sensitive stocks can benefit significantly. Biotechs are well-positioned as well. Recently, we wrote about the Biotech and Healthcare Outlook for the remainder of 2020.

But first, we need to get past next week.

The article was submitted on Oct 29 for publication first on Seeking Alpha.